Summary

Kramkov and Sirbu (2006, 2007) have shown that first-order approximations of power utility-based prices and hedging strategies can be computed by solving a mean-variance hedging problem under a specific equivalent martingale measure and relative to a suitable numeraire. In order to avoid the introduction of an additional state variable necessitated by the change of numeraire, we propose an alternative representation in terms of the original numeraire. More specifically, we characterize the relevant quantities using semimartingale characteristics similarly as in Cerny and Kallsen (2007) for mean-variance hedging. These results are illustrated by applying them to exponential L\'evy processes and stochastic volatility models of Barndorff-Nielsen and Shephard type.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

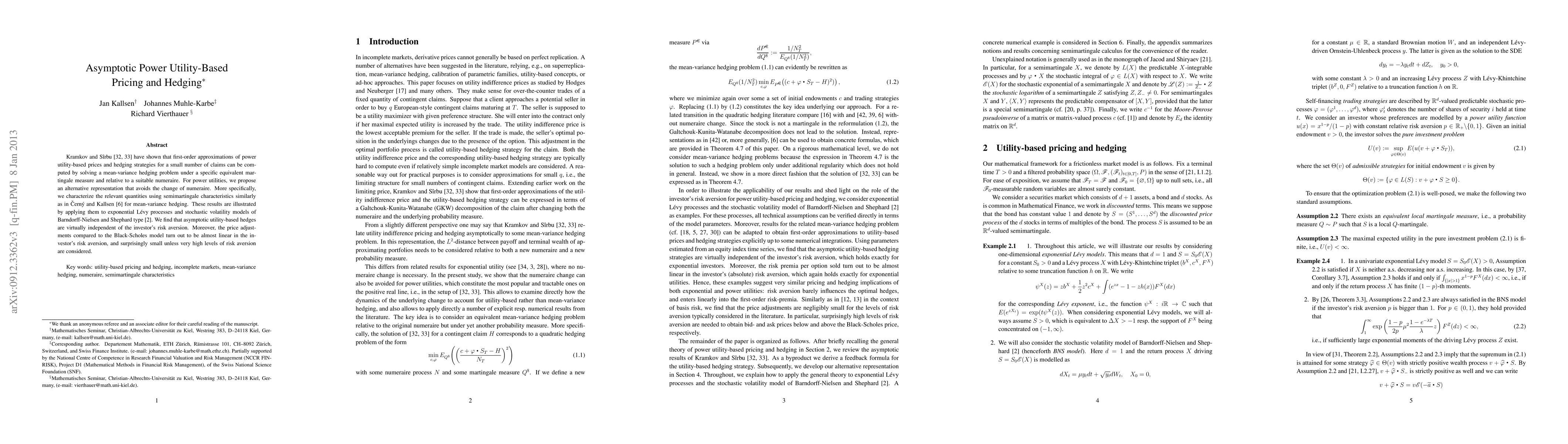

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)