Summary

The problem of hedging and pricing sequences of contingent claims in large financial markets is studied. Connection between asymptotic arbitrage and behavior of the $\alpha$~-~quantile price is shown. The large Black-Scholes model is carefully examined.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

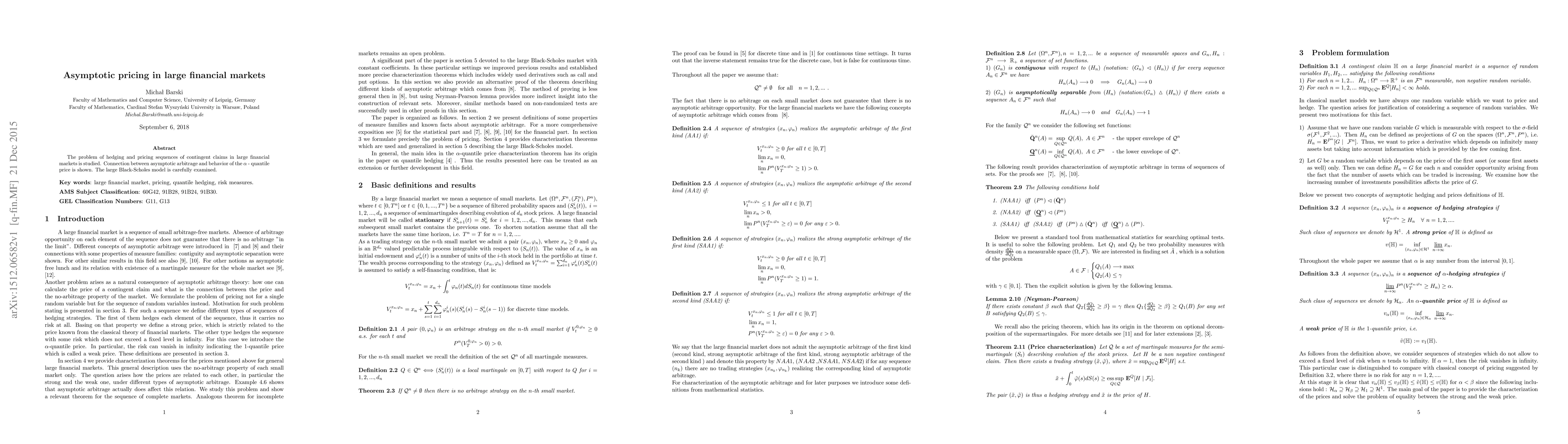

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA new perspective on the fundamental theorem of asset pricing for large financial markets

Josef Teichmann, Christa Cuchiero, Irene Klein

No citations found for this paper.

Comments (0)