Authors

Summary

We study maximum-likelihood-type estimation for diffusion processes when the coefficients are nonrandom and observation occurs in nonsynchronous manner. The problem of nonsynchronous observations is important when we consider the analysis of high-frequency data in a financial market. Constructing a quasi-likelihood function to define the estimator, we adaptively estimate the parameter for the diffusion part and the drift part. We consider the asymptotic theory when the terminal time point $T_n$ and the observation frequency goes to infinity, and show the consistency and the asymptotic normality of the estimator. Moreover, we show local asymptotic normality for the statistical model, and asymptotic efficiency of the estimator as a consequence. To show the asymptotic properties of the maximum-likelihood-type estimator, we need to control the asymptotic behaviors of some functionals of the sampling scheme. Though it is difficult to directly control those in general, we study tractable sufficient conditions when the sampling scheme is generated by mixing processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

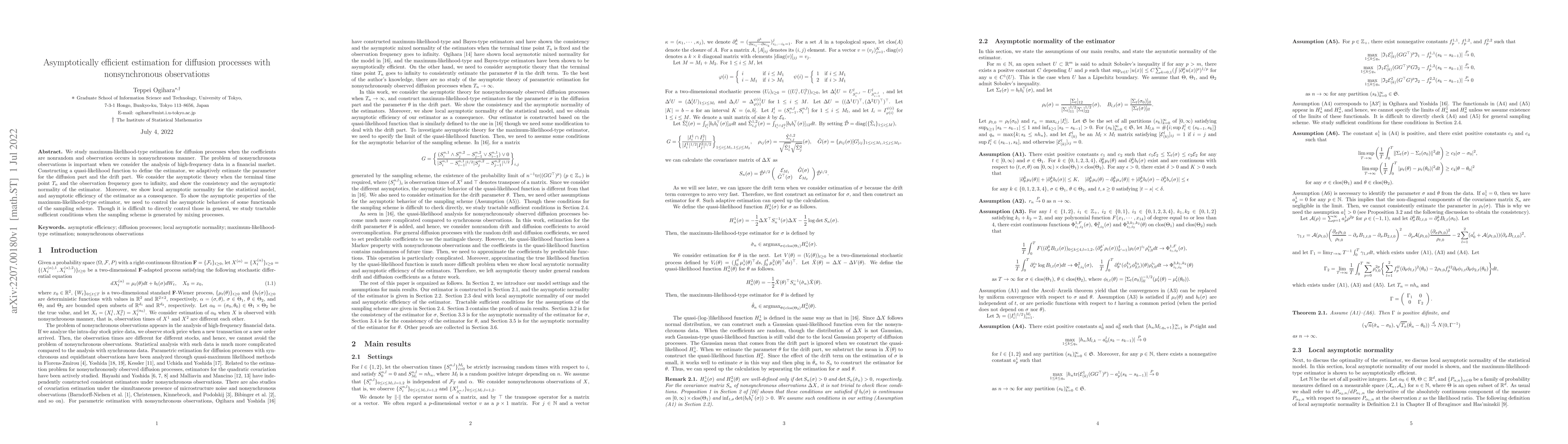

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAsymptotically uniformly most powerful tests for diffusion processes with nonsynchronous observations

Teppei Ogihara, Futo Ueno

No citations found for this paper.

Comments (0)