Summary

In this paper we consider the conservative Lasso which we argue penalizes more correctly than the Lasso and show how it may be desparsified in the sense of van de Geer et al. (2014) in order to construct asymptotically honest (uniform) confidence bands. In particular, we develop an oracle inequality for the conservative Lasso only assuming the existence of a certain number of moments. This is done by means of the Marcinkiewicz-Zygmund inequality. We allow for heteroskedastic non-subgaussian error terms and covariates. Next, we desparsify the conservative Lasso estimator and derive the asymptotic distribution of tests involving an increasing number of parameters. Our simulations reveal that the desparsified conservative Lasso estimates the parameters more precisely than the desparsified Lasso, has better size properties and produces confidence bands with superior coverage rates.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

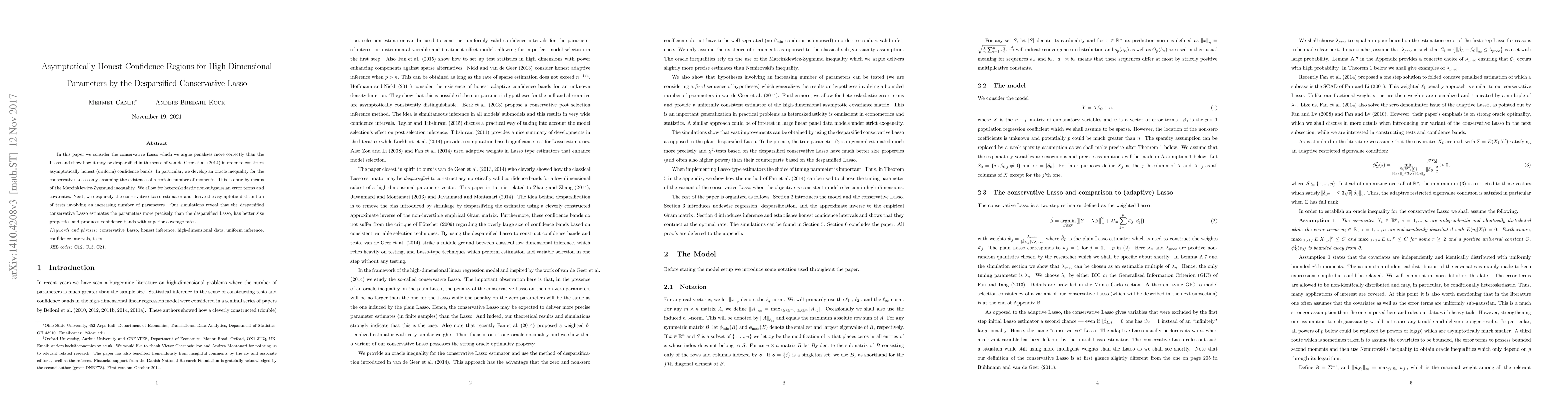

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)