Summary

We present small-time implied volatility asymptotics for Realised Variance (RV) and VIX options for a number of (rough) stochastic volatility models via large deviations principle. We provide numerical results along with efficient and robust numerical recipes to compute the rate function; the backbone of our theoretical framework. Based on our results, we further develop approximation schemes for the density of RV, which in turn allows to express the volatility swap in close-form. Lastly, we investigate different constructions of multi-factor models and how each of them affects the convexity of the implied volatility smile. Interestingly, we identify the class of models that generate non-linear smiles around-the-money.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper employs large deviations theory to analyze the small-time behavior of volatility derivatives in multi-factor rough volatility models, providing theoretical frameworks and numerical recipes.

Key Results

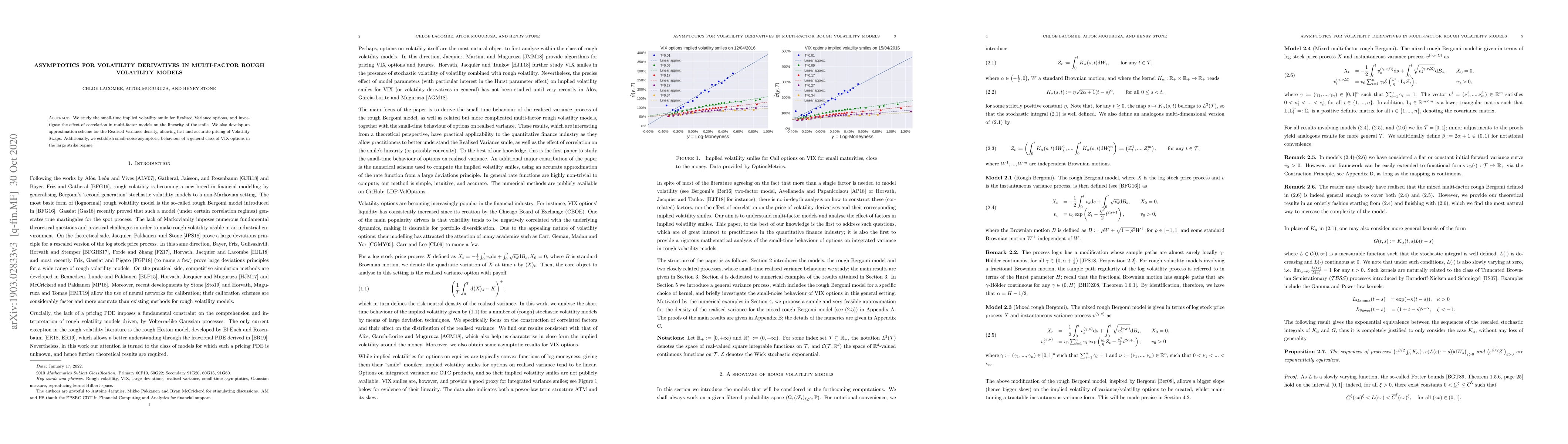

- Presented small-time implied volatility asymptotics for Realised Variance (RV) and VIX options in various rough stochastic volatility models.

- Developed approximation schemes for the density of RV, enabling close-form expression for volatility swaps.

- Identified a class of multi-factor models generating non-linear smiles around-the-money.

- Proved pathwise large deviation principle for rescaled VIX processes in a general setting with minimal assumptions on the kernel of the stochastic integral.

- Demonstrated that log-normal models like rough Bergomi, 2Factor Bergomi, and their mixed versions generate linear smiles around-the-money for options on realized variance.

Significance

This research provides a solid theoretical basis for understanding the small-time behavior of volatility derivatives, which aligns with observed market phenomena and previous theoretical results.

Technical Contribution

The paper establishes small-time asymptotics for volatility derivatives using large deviations theory and provides efficient numerical methods to compute the rate function.

Novelty

The work identifies a novel class of multi-factor rough volatility models that produce non-linear implied volatility smiles, distinguishing it from previous linear assumptions in lognormal models.

Limitations

- Theoretical results are primarily for models with increasing complexity, which may limit practical applicability for simpler models.

- Numerical approximations may not capture all nuances of real-world market dynamics.

Future Work

- Explore the application of these findings to other stochastic volatility models.

- Investigate the small-time behavior of VIX from the pathwise large deviation principle.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Efficient Calibration Framework for Volatility Derivatives under Rough Volatility with Jumps

Yuxuan Ouyang, Keyuan Wu, Tenghan Zhong

| Title | Authors | Year | Actions |

|---|

Comments (0)