Summary

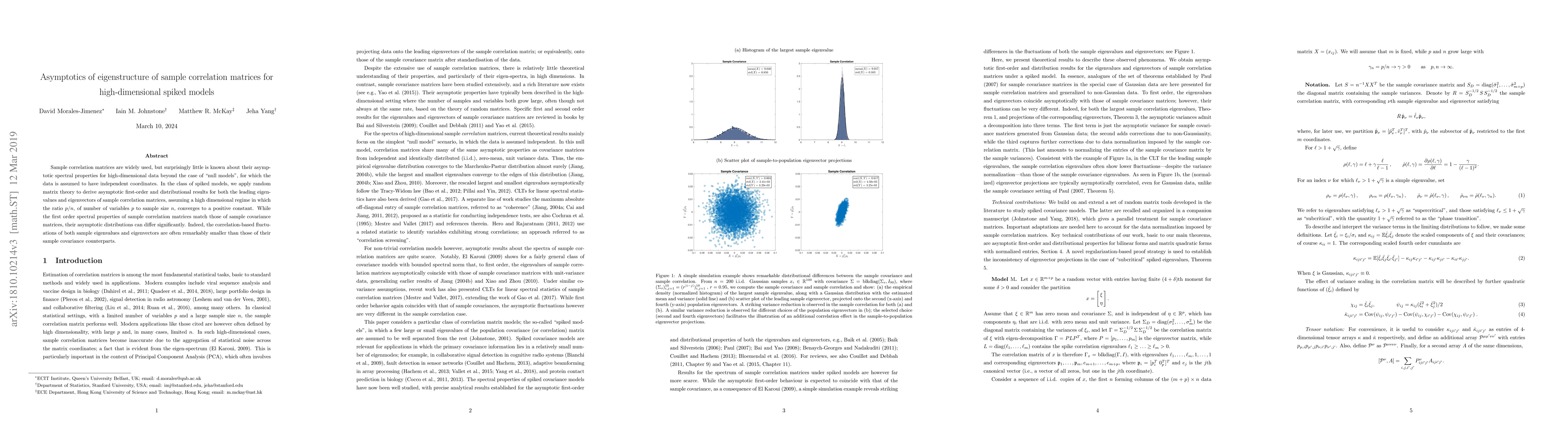

Sample correlation matrices are employed ubiquitously in statistics. However, quite surprisingly, little is known about their asymptotic spectral properties for high-dimensional data, particularly beyond the case of "null models" for which the data is assumed independent. Here, considering the popular class of spiked models, we apply random matrix theory to derive asymptotic first-order and distributional results for both the leading eigenvalues and eigenvectors of sample correlation matrices. These results are obtained under high-dimensional settings for which the number of samples n and variables p approach infinity, with p/n tending to a constant. To first order, the spectral properties of sample correlation matrices are seen to coincide with those of sample covariance matrices; however their asymptotic distributions can differ significantly, with fluctuations of both the sample eigenvalues and eigenvectors often being remarkably smaller than those of their sample covariance counterparts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSpiked eigenvalues of high-dimensional sample autocovariance matrices: CLT and applications

Xiao Han, Yanrong Yang, Daning Bi et al.

Posterior asymptotics of high-dimensional spiked covariance model with inverse-Wishart prior

Sewon Park, Seongmin Kim, Kwangmin Lee et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)