Authors

Summary

We introduce a general theory on stationary approximations for locally stationary continuous-time processes. Based on the stationary approximation, we use $\theta$-weak dependence to establish laws of large numbers and central limit type results under different observation schemes. Hereditary properties for a large class of finite and infinite memory transformations show the flexibility of the developed theory. Sufficient conditions for the existence of stationary approximations for time-varying L\'evy-driven state space models are derived and compared to existing results. We conclude with comprehensive results on the asymptotic behavior of the first and second order localized sample moments of time-varying L\'evy-driven state space models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

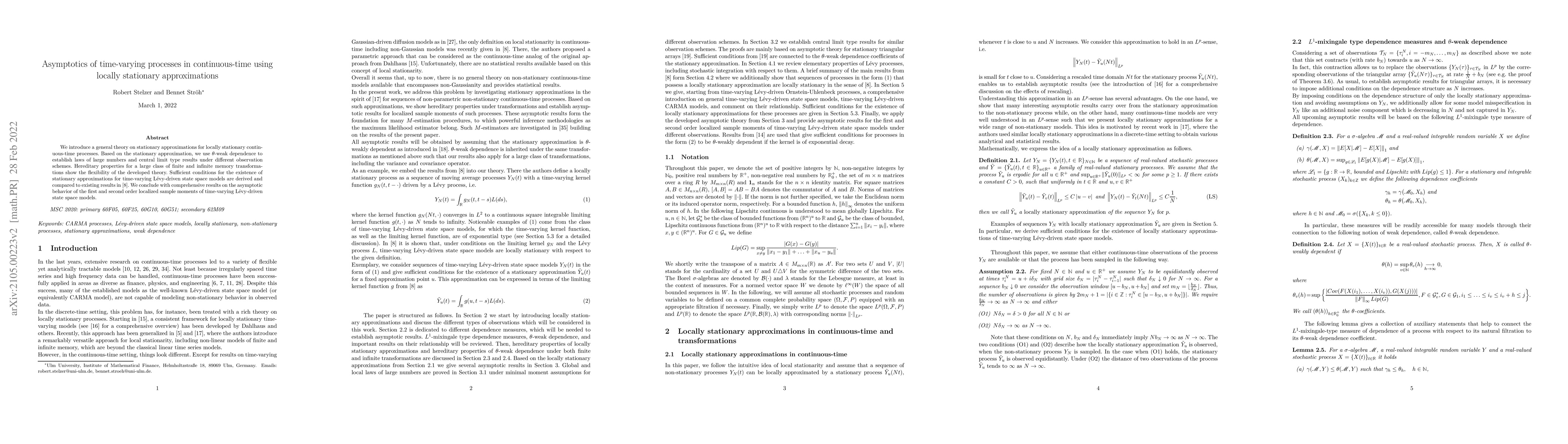

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContinuous Time Locally Stationary Wavelet Processes

Henry Antonio Palasciano, Marina I. Knight, Guy P. Nason

No citations found for this paper.

Comments (0)