Authors

Summary

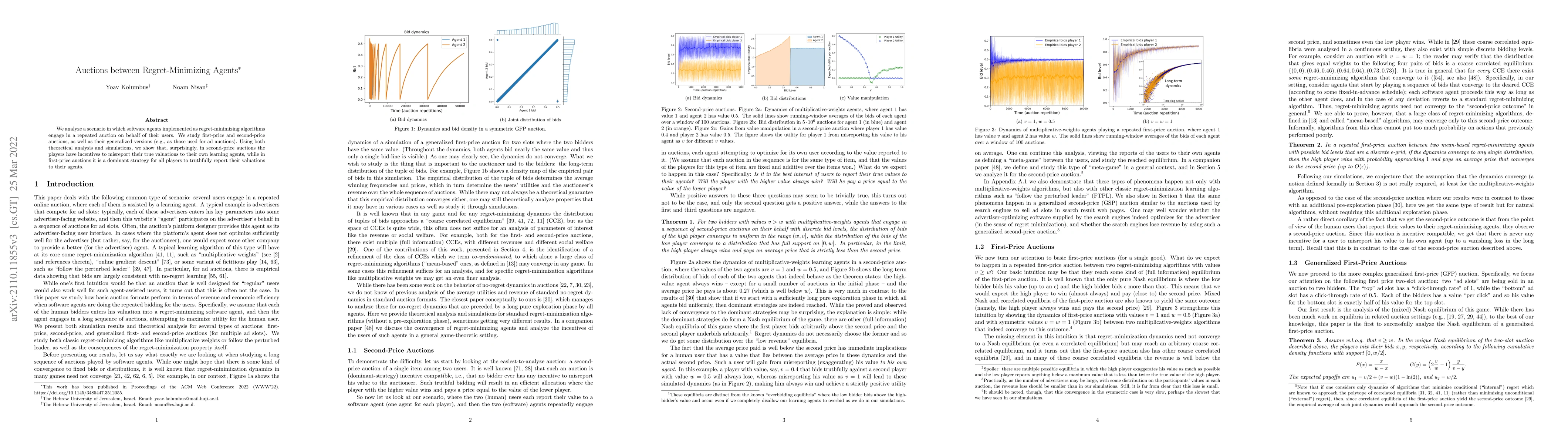

We analyze a scenario in which software agents implemented as regret-minimizing algorithms engage in a repeated auction on behalf of their users. We study first-price and second-price auctions, as well as their generalized versions (e.g., as those used for ad auctions). Using both theoretical analysis and simulations, we show that, surprisingly, in second-price auctions the players have incentives to misreport their true valuations to their own learning agents, while in the first-price auction it is a dominant strategy for all players to truthfully report their valuations to their agents.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper analyzes repeated auctions between regret-minimizing agents using both theoretical analysis and simulations, focusing on first-price and second-price auctions, including their generalized versions like those used in ad auctions.

Key Results

- In second-price auctions, players have incentives to misreport true valuations to their learning agents, contrary to the dominant strategy of truthful reporting in first-price auctions.

- For first-price auctions, truthful reporting of valuations to learning agents is a dominant strategy for all players.

- Theoretical results are consistent with simulation outcomes, showing that in second-price auctions, bids cluster around the second-highest valuation, while in first-price auctions, bids cluster around the true valuation.

Significance

This research is significant as it reveals the behavioral differences between regret-minimizing agents in first-price versus second-price auctions, which can inform the design of auction mechanisms for platforms like online advertising.

Technical Contribution

The paper establishes a connection between mean-based regret-minimization algorithms and co-undominated Correlated Equilibria (CCE), providing theoretical insights into the behavior of regret-minimizing agents in auctions.

Novelty

The novelty lies in uncovering the contrasting incentives for truthful bidding in first-price versus second-price auctions among regret-minimizing agents, which challenges the conventional understanding of incentive compatibility in auction theory.

Limitations

- The study is limited to regret-minimizing agents and does not explore how other types of bidders (e.g., myopic, strategic) might behave differently.

- Simulations are based on specific models (multiplicative weights and FTPL) and might not generalize to all learning algorithms used in practice.

Future Work

- Investigate how different learning algorithms impact auction outcomes.

- Explore the implications of these findings for more complex auction formats beyond single-item auctions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStrategizing against No-Regret Learners in First-Price Auctions

Aviad Rubinstein, Junyao Zhao

Randomized Truthful Auctions with Learning Agents

Anupam Gupta, Grigoris Velegkas, Andres Perlroth et al.

Budget Pacing in Repeated Auctions: Regret and Efficiency without Convergence

Brendan Lucier, Aleksandrs Slivkins, Bar Light et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)