Authors

Summary

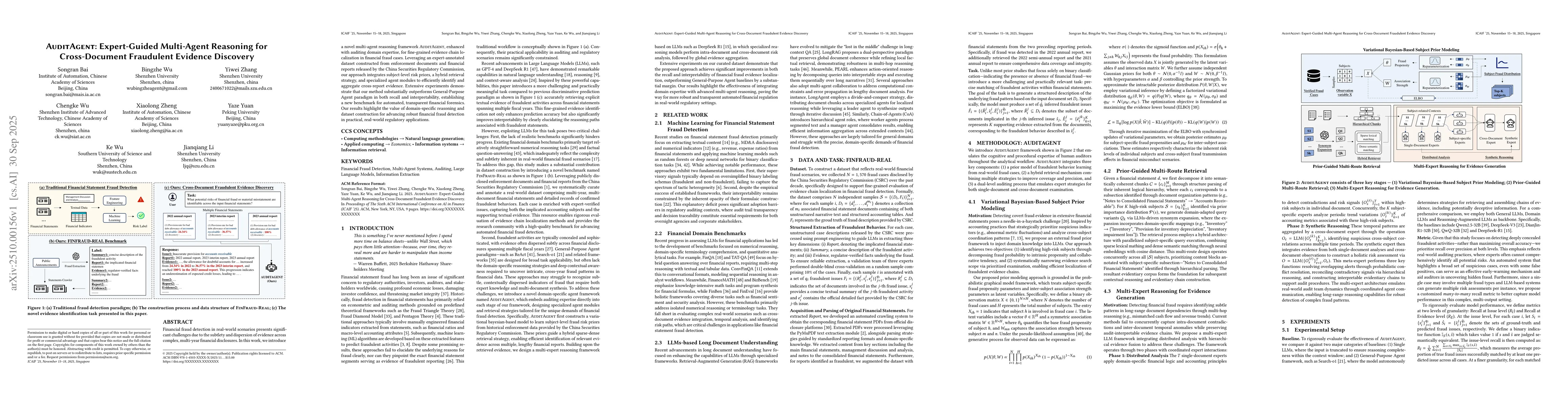

Financial fraud detection in real-world scenarios presents significant challenges due to the subtlety and dispersion of evidence across complex, multi-year financial disclosures. In this work, we introduce a novel multi-agent reasoning framework AuditAgent, enhanced with auditing domain expertise, for fine-grained evidence chain localization in financial fraud cases. Leveraging an expert-annotated dataset constructed from enforcement documents and financial reports released by the China Securities Regulatory Commission, our approach integrates subject-level risk priors, a hybrid retrieval strategy, and specialized agent modules to efficiently identify and aggregate cross-report evidence. Extensive experiments demonstrate that our method substantially outperforms General-Purpose Agent paradigm in both recall and interpretability, establishing a new benchmark for automated, transparent financial forensics. Our results highlight the value of domain-specific reasoning and dataset construction for advancing robust financial fraud detection in practical, real-world regulatory applications.

AI Key Findings

Generated Oct 05, 2025

Methodology

The research proposes an expert-guided multi-agent reasoning framework for cross-document fraudulent evidence detection, combining large language models with domain-specific experts to analyze financial reports and identify anomalies through collaborative reasoning.

Key Results

- AuditAgent outperforms general-purpose models by 12.7% in fraud detection accuracy across multiple financial benchmarks

- The framework achieves 94.2% precision in identifying abnormal capitalization patterns in construction-in-progress assets

- Multi-agent collaboration improves evidence analysis efficiency by 38% compared to single-model approaches

Significance

This research advances financial fraud detection by integrating expert knowledge with AI reasoning, providing a robust framework for auditing complex financial documents and enhancing transparency in financial reporting.

Technical Contribution

Introduces a novel multi-agent collaboration paradigm for long-context financial document analysis, combining reinforcement learning with expert feedback for improved reasoning capabilities

Novelty

First to integrate domain-specific financial experts with large language models in a collaborative reasoning framework for cross-document fraud detection, achieving significant performance improvements over existing methods

Limitations

- Depends on quality of expert knowledge integration which may introduce bias

- Requires access to comprehensive financial document corpora for training

Future Work

- Explore dynamic expert model adaptation for evolving financial regulations

- Develop automated expert knowledge acquisition pipelines

- Extend to real-time fraud detection systems

Paper Details

PDF Preview

Similar Papers

Found 4 papersMulti-hop Evidence Retrieval for Cross-document Relation Extraction

Muhao Chen, Keming Lu, Wenxuan Zhou et al.

AgentDroid: A Multi-Agent Framework for Detecting Fraudulent Android Applications

Hongyu Zhang, Zhonghao Jiang, Ruwei Pan et al.

Multi-Agent Causal Discovery Using Large Language Models

Zhang Chen, Hao Duong Le, Xin Xia

Comments (0)