Summary

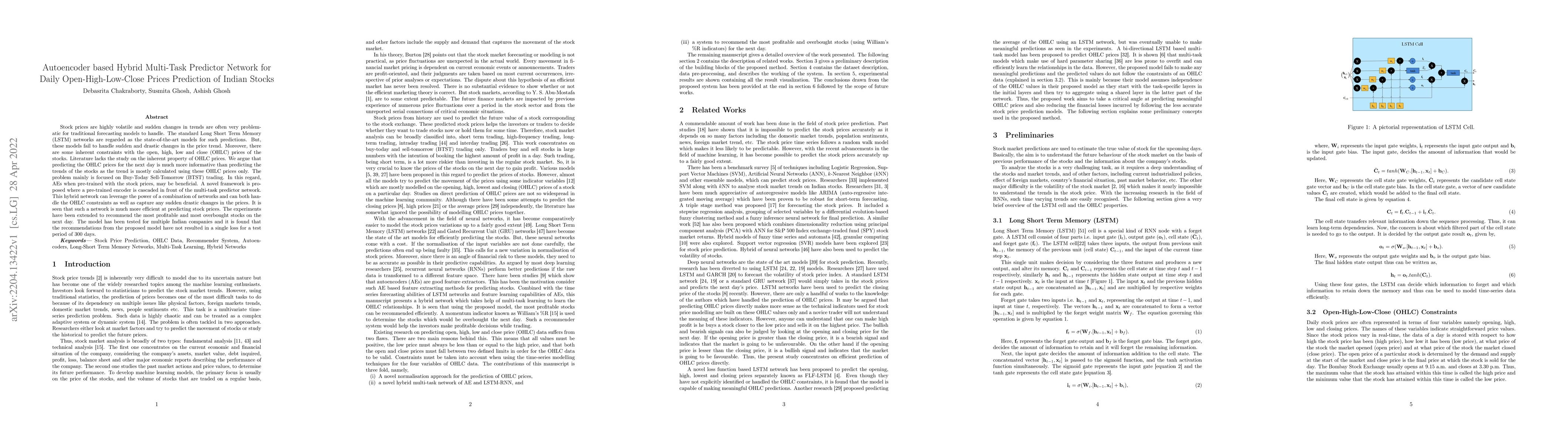

Stock prices are highly volatile and sudden changes in trends are often very problematic for traditional forecasting models to handle. The standard Long Short Term Memory (LSTM) networks are regarded as the state-of-the-art models for such predictions. But, these models fail to handle sudden and drastic changes in the price trend. Moreover, there are some inherent constraints with the open, high, low and close (OHLC) prices of the stocks. Literature lacks the study on the inherent property of OHLC prices. We argue that predicting the OHLC prices for the next day is much more informative than predicting the trends of the stocks as the trend is mostly calculated using these OHLC prices only. The problem mainly is focused on Buy-Today Sell-Tomorrow (BTST) trading. In this regard, AEs when pre-trained with the stock prices, may be beneficial. A novel framework is proposed where a pre-trained encoder is cascaded in front of the multi-task predictor network. This hybrid network can leverage the power of a combination of networks and can both handle the OHLC constraints as well as capture any sudden drastic changes in the prices. It is seen that such a network is much more efficient at predicting stock prices. The experiments have been extended to recommend the most profitable and most overbought stocks on the next day. The model has been tested for multiple Indian companies and it is found that the recommendations from the proposed model have not resulted in a single loss for a test period of 300 days.

AI Key Findings

Generated Sep 07, 2025

Methodology

The paper proposes a hybrid Autoencoder (AE) and Multi-Task Learning (MTL) network for predicting daily Open-High-Low-Close (OHLC) prices of Indian stocks, addressing the limitations of traditional LSTM models in handling sudden price changes and OHLC constraints.

Key Results

- The proposed hybrid AE-MTL model effectively handles OHLC constraints and captures sudden price changes, outperforming existing methods.

- Experiments on 27 Indian companies' stocks over 300 days showed no losses from model recommendations, indicating high profitability.

- The model's performance was superior, as evidenced by lower RMSE, MAE, and MAPE compared to other methods.

- The use of AE enhanced the performance of the MTL model, demonstrating the benefits of AE in stock market prediction.

Significance

This research is significant as it addresses the gap in applying machine learning to financial prediction tasks, particularly focusing on OHLC price prediction, which has been largely overlooked in literature.

Technical Contribution

The novel normalization strategy for OHLC data and the use of pre-trained encoder modules in the MTL model are key technical contributions.

Novelty

This work is novel due to its unique approach to normalizing OHLC data and utilizing AE for handling drastic stock price fluctuations, which sets it apart from existing literature.

Limitations

- The model does not consider other technical indicators used by financial analysts.

- Volume data is not incorporated due to missing information for some companies.

Future Work

- Planned to extend the model to incorporate fundamental and technical analysis for more comprehensive stock recommendations.

- Aim to make predictions for very short-term or very long-term trading purposes.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-task Envisioning Transformer-based Autoencoder for Corporate Credit Rating Migration Early Prediction

Hongfu Liu, Han Yue, Steve Xia

A multi-task network approach for calculating discrimination-free insurance prices

Mario V. Wüthrich, Ronald Richman, Mathias Lindholm et al.

No citations found for this paper.

Comments (0)