Summary

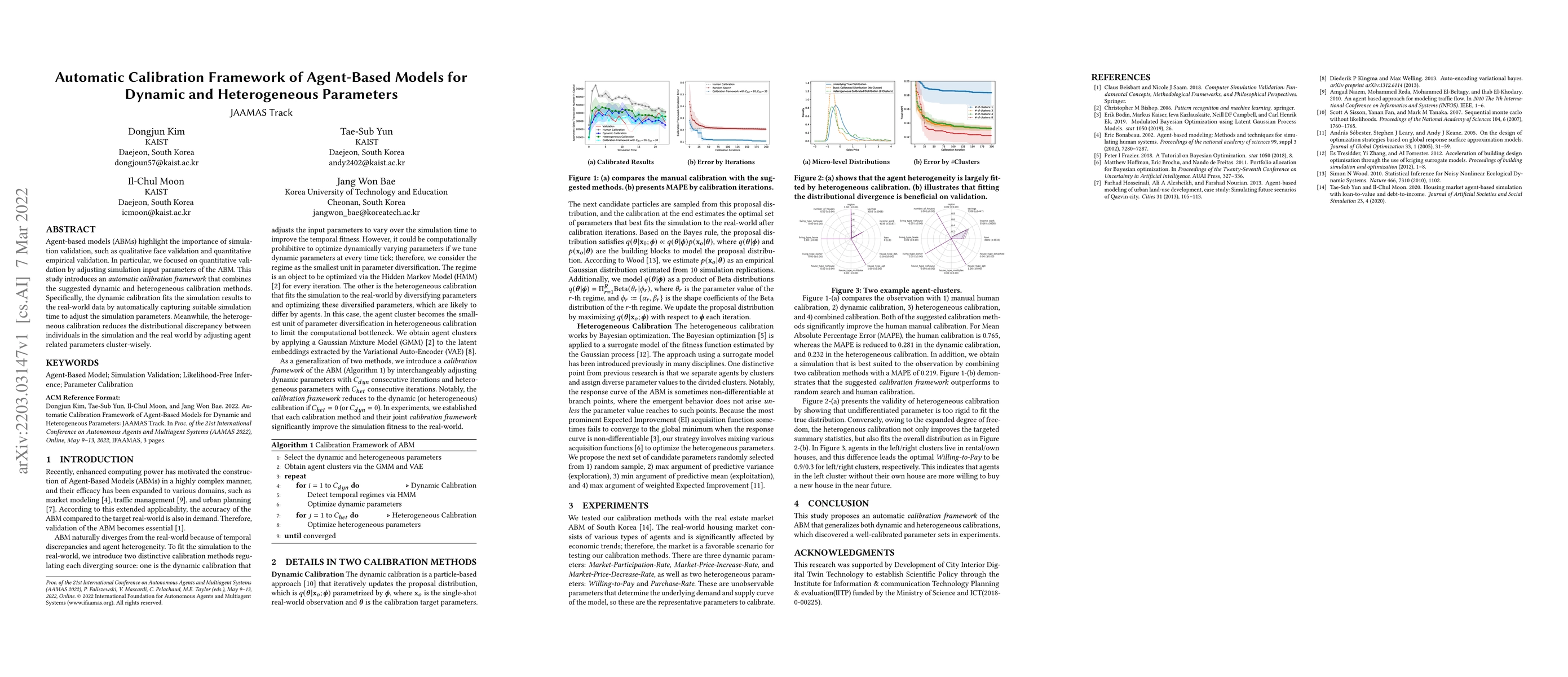

Agent-based models (ABMs) highlight the importance of simulation validation, such as qualitative face validation and quantitative empirical validation. In particular, we focused on quantitative validation by adjusting simulation input parameters of the ABM. This study introduces an automatic calibration framework that combines the suggested dynamic and heterogeneous calibration methods. Specifically, the dynamic calibration fits the simulation results to the real-world data by automatically capturing suitable simulation time to adjust the simulation parameters. Meanwhile, the heterogeneous calibration reduces the distributional discrepancy between individuals in the simulation and the real world by adjusting agent related parameters cluster-wisely.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)