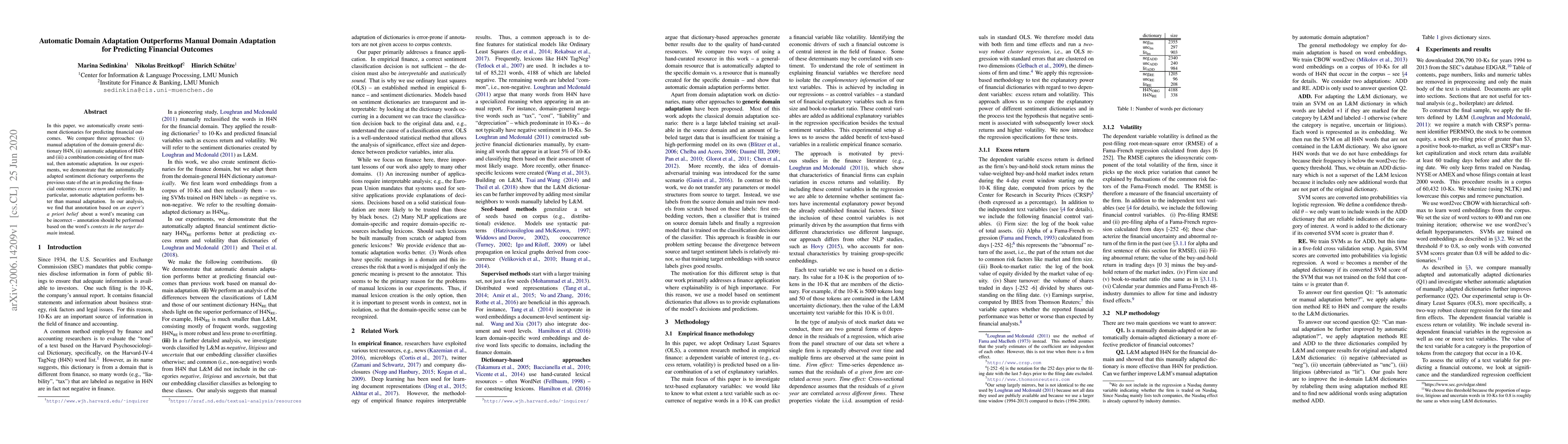

Summary

In this paper, we automatically create sentiment dictionaries for predicting financial outcomes. We compare three approaches: (I) manual adaptation of the domain-general dictionary H4N, (ii) automatic adaptation of H4N and (iii) a combination consisting of first manual, then automatic adaptation. In our experiments, we demonstrate that the automatically adapted sentiment dictionary outperforms the previous state of the art in predicting the financial outcomes excess return and volatility. In particular, automatic adaptation performs better than manual adaptation. In our analysis, we find that annotation based on an expert's a priori belief about a word's meaning can be incorrect -- annotation should be performed based on the word's contexts in the target domain instead.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDomain Adaptation for Arabic Machine Translation: The Case of Financial Texts

Emad A. Alghamdi, Jezia Zakraoui, Fares A. Abanmy

Transliterated Zero-Shot Domain Adaptation for Automatic Speech Recognition

Han Zhu, Pengyuan Zhang, Gaofeng Cheng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)