Authors

Summary

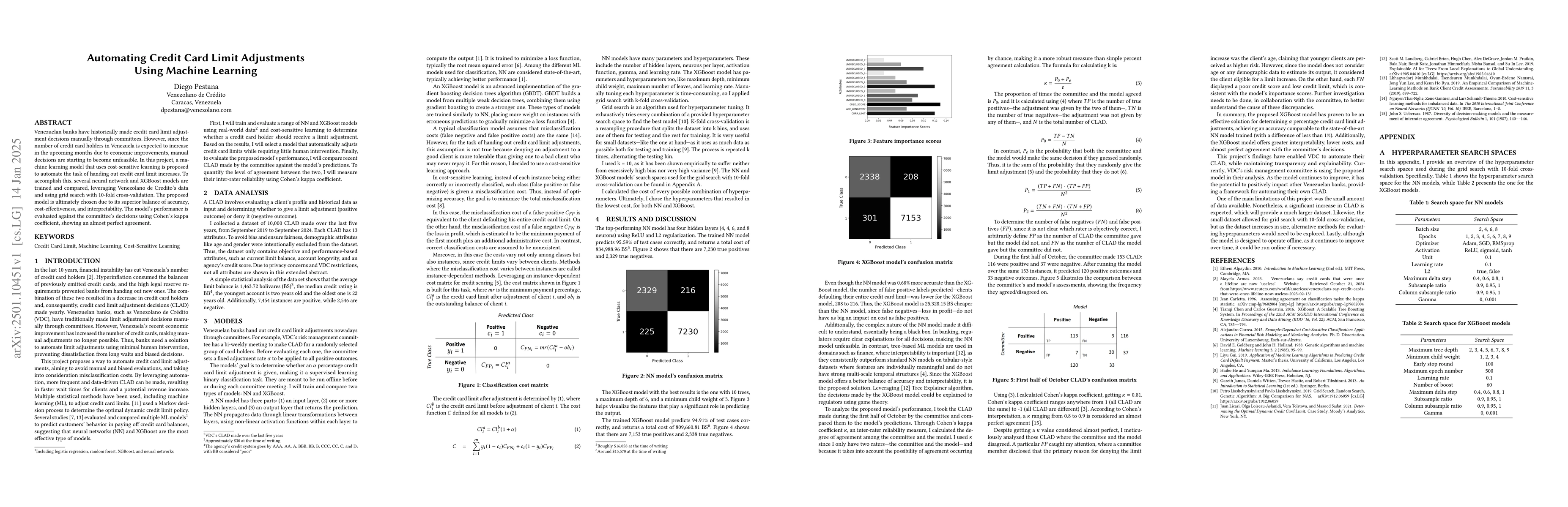

Venezuelan banks have historically made credit card limit adjustment decisions manually through committees. However, since the number of credit card holders in Venezuela is expected to increase in the upcoming months due to economic improvements, manual decisions are starting to become unfeasible. In this project, a machine learning model that uses cost-sensitive learning is proposed to automate the task of handing out credit card limit increases. To accomplish this, several neural network and XGBoost models are trained and compared, leveraging Venezolano de Credito's data and using grid search with 10-fold cross-validation. The proposed model is ultimately chosen due to its superior balance of accuracy, cost-effectiveness, and interpretability. The model's performance is evaluated against the committee's decisions using Cohen's kappa coefficient, showing an almost perfect agreement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCredit card score prediction using machine learning models: A new dataset

Alaa Sulaiman, Anas Arram, Masri Ayob et al.

Optimizing Credit Limit Adjustments Under Adversarial Goals Using Reinforcement Learning

Cristián Bravo, Sherly Alfonso-Sánchez, Jesús Solano et al.

An Integrated Machine Learning and Deep Learning Framework for Credit Card Approval Prediction

Yijing Wei, Yanxin Shen, Yujian Long et al.

No citations found for this paper.

Comments (0)