Summary

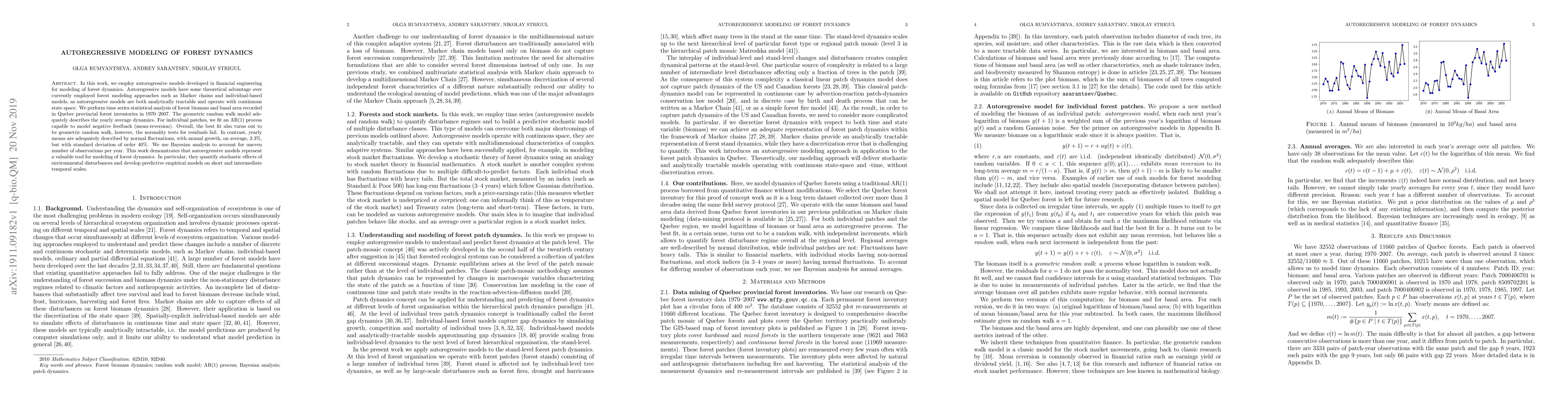

In this work, we employ autoregressive models developed in financial engineering for modeling of forest dynamics. Autoregressive models have some theoretical advantage over currently employed forest modeling approaches such as Markov chains and individual-based models, as autoregressive models are both analytically tractable and operate with continuous state space. We perform time series statistical analysis of forest biomass and basal area recorded in Quebec provincial forest inventories in 1970-2007. The geometric random walk model adequately describes the yearly average dynamics. For individual patches, we fit an AR(1) process capable to model negative feedback (mean-reversion). Overall, the best fit also turns out to be geometric random walk, however, the normality tests for residuals fail. In contrast, yearly means are adequately described by normal fluctuations, with annual growth, on average, 2.3%, but with standard deviation of order 40%. We use Bayesian analysis to account for uneven number of observations per year. This work demonstrates that autoregressive models represent a valuable tool for modeling of forest dynamics. In particular, they quantify stochastic effects of environmental disturbances and develop predictive empirical models on short and intermediate temporal scales.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSpatial modeling of forest-savanna bistability: Impacts of fire dynamics and timescale separation

Simon Levin, Denis D. Patterson, Kimberly Shen

AutoAvatar: Autoregressive Neural Fields for Dynamic Avatar Modeling

Shunsuke Saito, Ping Tan, Timur Bagautdinov et al.

ACDiT: Interpolating Autoregressive Conditional Modeling and Diffusion Transformer

Zhiyuan Liu, Maosong Sun, Hao Zhou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)