Summary

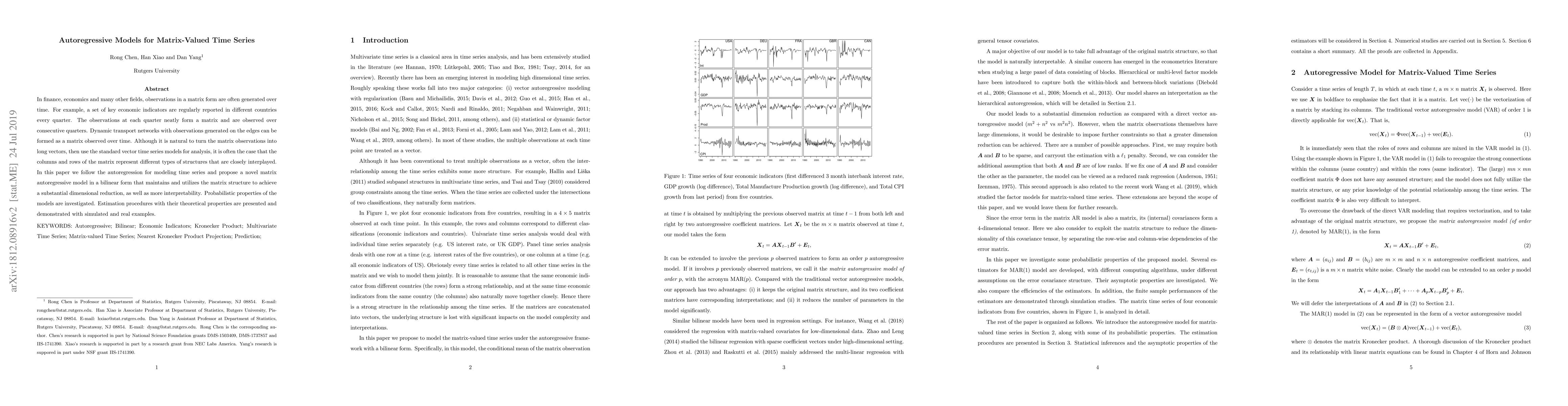

In finance, economics and many other fields, observations in a matrix form are often generated over time. For example, a set of key economic indicators are regularly reported in different countries every quarter. The observations at each quarter neatly form a matrix and are observed over many consecutive quarters. Dynamic transport networks with observations generated on the edges can be formed as a matrix observed over time. Although it is natural to turn the matrix observations into a long vector, and then use the standard vector time series models for analysis, it is often the case that the columns and rows of the matrix represent different types of structures that are closely interplayed. In this paper we follow the autoregressive structure for modeling time series and propose a novel matrix autoregressive model in a bilinear form that maintains and utilizes the matrix structure to achieve a greater dimensional reduction, as well as more interpretable results. Probabilistic properties of the models are investigated. Estimation procedures with their theoretical properties are presented and demonstrated with simulated and real examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMatrix Autoregressive Model with Vector Time Series Covariates for Spatio-Temporal Data

Yang Chen, Zuofeng Shang, Hu Sun

| Title | Authors | Year | Actions |

|---|

Comments (0)