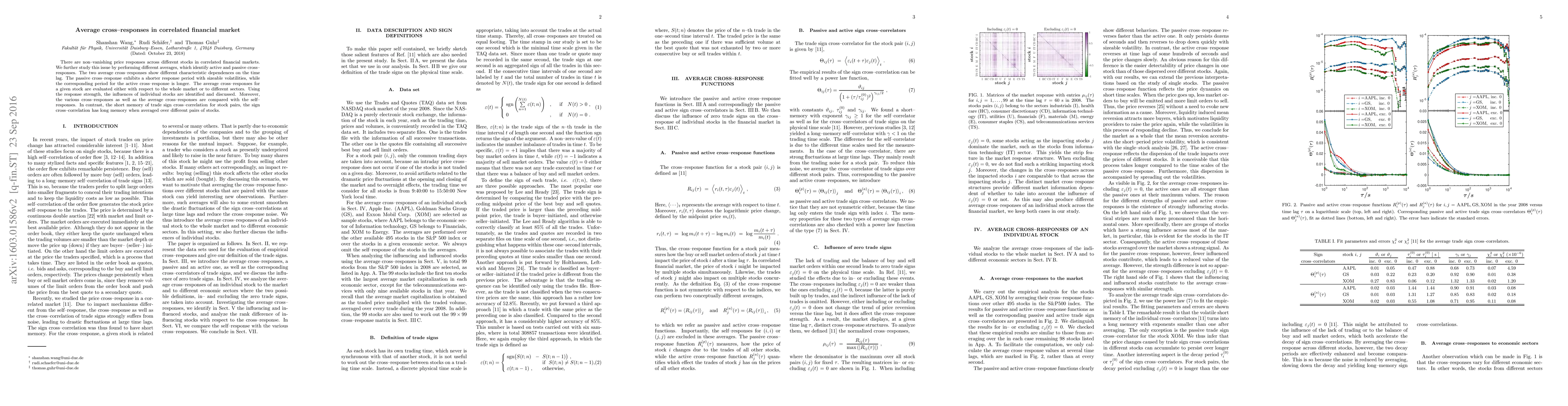

Summary

There are non-vanishing price responses across different stocks in correlated financial markets. We further study this issue by performing different averages, which identify active and passive cross-responses. The two average cross-responses show different characteristic dependences on the time lag. The passive cross-response exhibits a shorter response period with sizeable volatilities, while the corresponding period for the active cross-response is longer. The average cross-responses for a given stock are evaluated either with respect to the whole market or to different sectors. Using the response strength, the influences of individual stocks are identified and discussed. Moreover, the various cross-responses as well as the average cross-responses are compared with the self-responses. In contrast, the short memory of trade sign cross-correlation for stock pairs, the sign cross-correlation has long memory when averaged over different pairs of stocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-Modal Temporal Fusion for Financial Market Forecasting

John Cartlidge, Yunhua Pei, Daniel Gold et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)