Summary

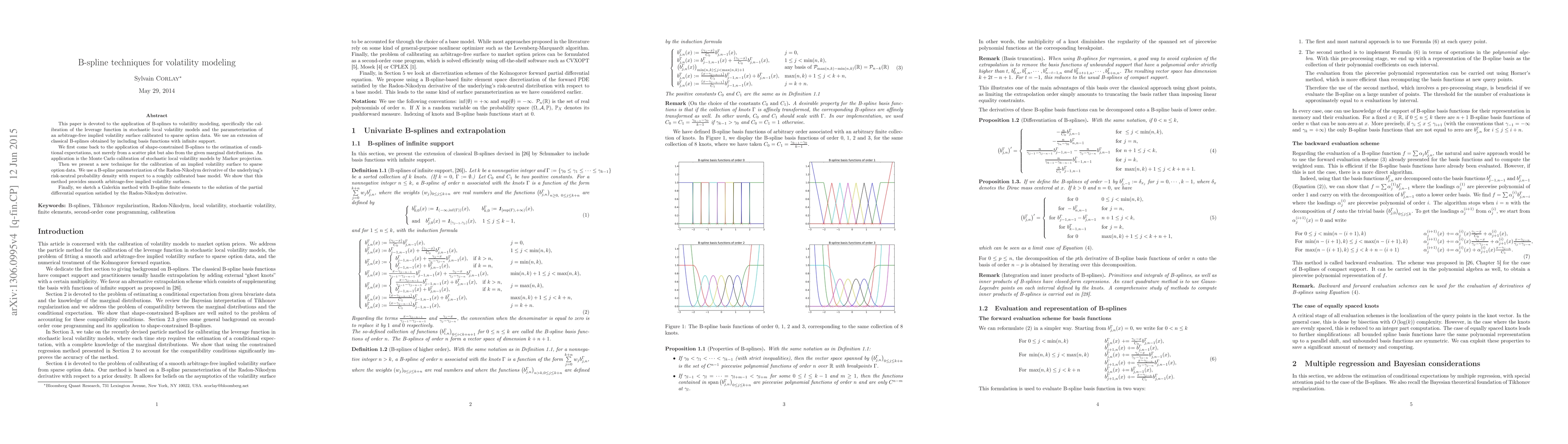

This paper is devoted to the application of B-splines to volatility modeling, specifically the calibration of the leverage function in stochastic local volatility models and the parameterization of an arbitrage-free implied volatility surface calibrated to sparse option data. We use an extension of classical B-splines obtained by including basis functions with infinite support. We first come back to the application of shape-constrained B-splines to the estimation of conditional expectations, not merely from a scatter plot but also from the given marginal distributions. An application is the Monte Carlo calibration of stochastic local volatility models by Markov projection. Then we present a new technique for the calibration of an implied volatility surface to sparse option data. We use a B-spline parameterization of the Radon-Nikodym derivative of the underlying's risk-neutral probability density with respect to a roughly calibrated base model. We show that this method provides smooth arbitrage-free implied volatility surfaces. Finally, we sketch a Galerkin method with B-spline finite elements to the solution of the partial differential equation satisfied by the Radon-Nikodym derivative.

AI Key Findings

Generated Sep 04, 2025

Methodology

Shape-constrained B-splines were used for two problems arising in volatility modeling.

Key Results

- Improved accuracy with the same sample size

- Smooth implied volatility surfaces

- Calibration conditions were met

Significance

This research contributes to the field of volatility modeling by providing a novel approach to calibration and interpolation.

Technical Contribution

The application of shape-constrained B-splines to volatility modeling problems.

Novelty

This work provides a novel approach to calibration and interpolation, leveraging shape-constrained B-splines.

Limitations

- Non-parametric regression was used

- Additional information from marginal distributions could be explored

Future Work

- Optimizing knot selection for B-spline regression

- Exploring the use of shape-constrained B-splines in other fields

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Review on Higher Order Spline Techniques for Solving Burgers Equation using B-Spline methods and Variation of B-Spline Techniques

Maryam Khazaei Pool, Lori Lewis

Customizable Adaptive Regularization Techniques for B-Spline Modeling

Tom Peterka, Vijay Mahadevan, David Lenz et al.

Constrained B-Spline Based Everett Map Construction for Modeling Static Hysteresis Behavior

Bram Daniels, Mitrofan Curti, Reza Zeinali et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)