Summary

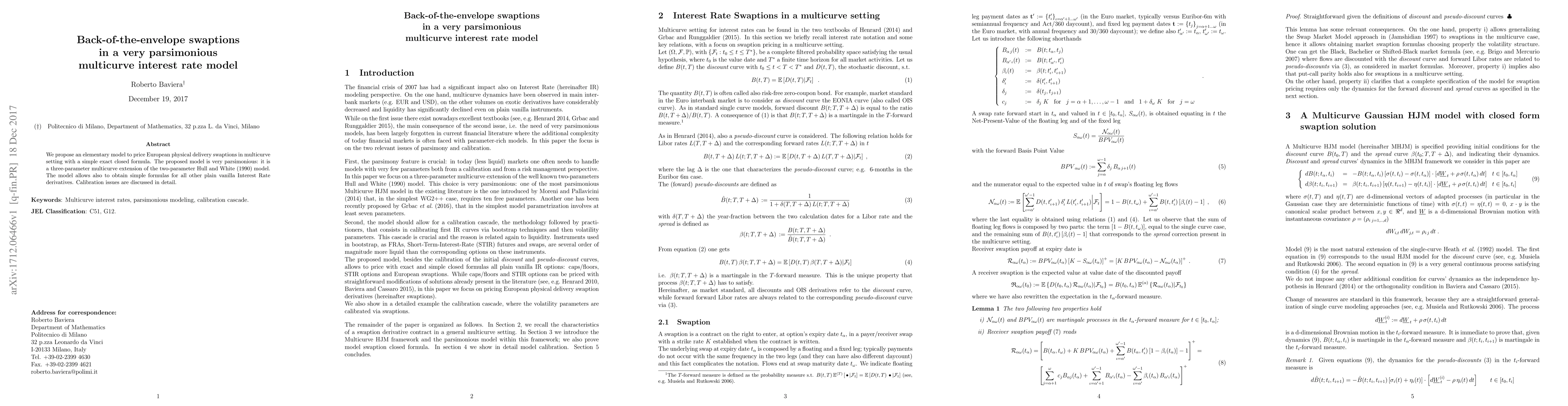

We propose an elementary model to price European physical delivery swaptions in multicurve setting with a simple exact closed formula. The proposed model is very parsimonious: it is a three-parameter multicurve extension of the two-parameter Hull-White (1990) model. The model allows also to obtain simple formulas for all other plain vanilla Interest Rate derivatives. Calibration issues are discussed in detail.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)