Authors

Summary

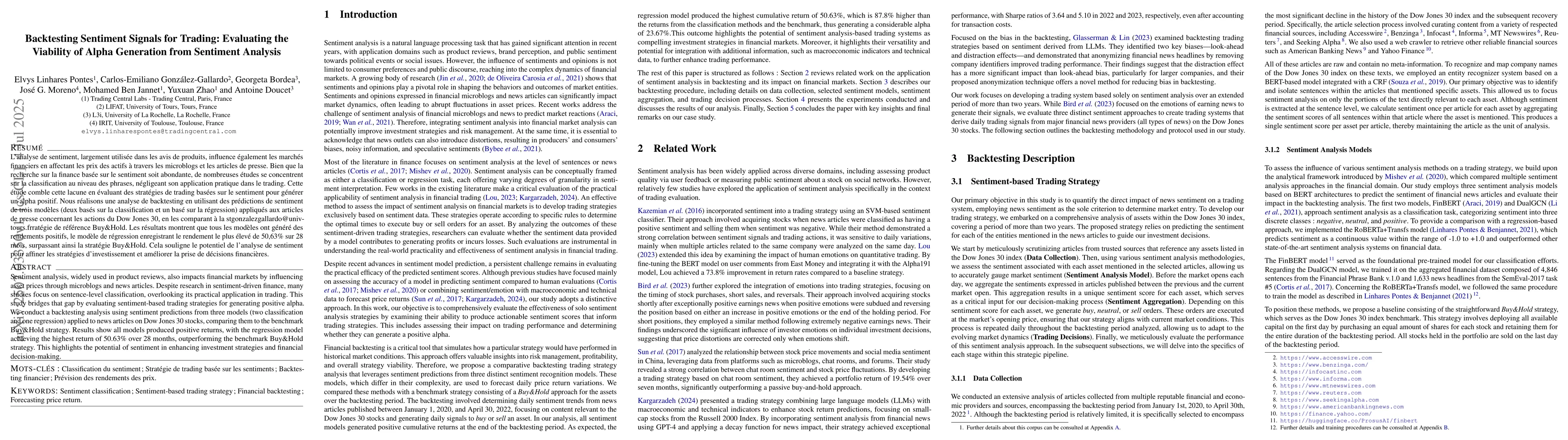

Sentiment analysis, widely used in product reviews, also impacts financial markets by influencing asset prices through microblogs and news articles. Despite research in sentiment-driven finance, many studies focus on sentence-level classification, overlooking its practical application in trading. This study bridges that gap by evaluating sentiment-based trading strategies for generating positive alpha. We conduct a backtesting analysis using sentiment predictions from three models (two classification and one regression) applied to news articles on Dow Jones 30 stocks, comparing them to the benchmark Buy&Hold strategy. Results show all models produced positive returns, with the regression model achieving the highest return of 50.63% over 28 months, outperforming the benchmark Buy&Hold strategy. This highlights the potential of sentiment in enhancing investment strategies and financial decision-making.

AI Key Findings

Generated Sep 03, 2025

Methodology

This study evaluates sentiment-based trading strategies by backtesting three models (two classification and one regression) on news articles related to Dow Jones 30 stocks, comparing their performance to a Buy&Hold benchmark.

Key Results

- All three models generated positive returns, with the regression model achieving the highest return of 50.63% over 28 months, outperforming the Buy&Hold strategy.

- RoBERTa+Transf model yielded superior returns compared to other methods, attributed to its ability to predict sentiment scores as floating-point values rather than discrete classes.

- RoBERTa+Transf strategy demonstrated the best risk-adjusted performance, with the highest Calmar, Sharpe, and Sortino ratios among all approaches.

Significance

The research highlights the potential of sentiment analysis in enhancing investment strategies and financial decision-making by generating positive alpha.

Technical Contribution

The paper proposes a backtesting framework for evaluating sentiment scores predicted by machine learning models in trading strategies, demonstrating the effectiveness of using floating-point sentiment predictions over discrete classes.

Novelty

The research distinguishes itself by focusing on the practical application of sentiment analysis in trading, emphasizing the superior performance of models predicting sentiment as floating-point values rather than discrete classes.

Limitations

- The study focuses on Dow Jones 30 stocks and news articles, which may limit the generalizability of findings to other markets or asset classes.

- Backtesting results may not fully reflect real-world trading performance due to factors like transaction costs, slippage, and model adaptability to changing market conditions.

Future Work

- Expand the analysis to include more diverse stock markets and asset classes to assess the generalizability of the findings.

- Investigate the impact of transaction costs, slippage, and model adaptability on the performance of sentiment-based trading strategies in real-world scenarios.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplying News and Media Sentiment Analysis for Generating Forex Trading Signals

Oluwafemi F Olaiyapo

Enhancing Trading Performance Through Sentiment Analysis with Large Language Models: Evidence from the S&P 500

Zihan Lin, Haojie Liu, Randall R. Rojas

Learning the Market: Sentiment-Based Ensemble Trading Agents

Yi Wang, Ryan Chen, Vipin Chaudhary et al.

No citations found for this paper.

Comments (0)