Summary

Backward doubly stochastic Volterra integral equations (BDSVIEs, for short) are introduced and studied systematically. Well-posedness of BDSVIEs in the sense of introduced M-solutions is established. A comparison theorem for BDSVIEs is proved. By virtue of the comparison theorem, we derive the existence of solutions for BDSVIEs with continuous coefficients. Furthermore, a duality principle between linear (forward) doubly stochastic Volterra integral equation (FDSVIE, for short) and BDSVIE is obtained. A Pontryagin type maximum principle is also established for an optimal control problem of FDSVIEs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

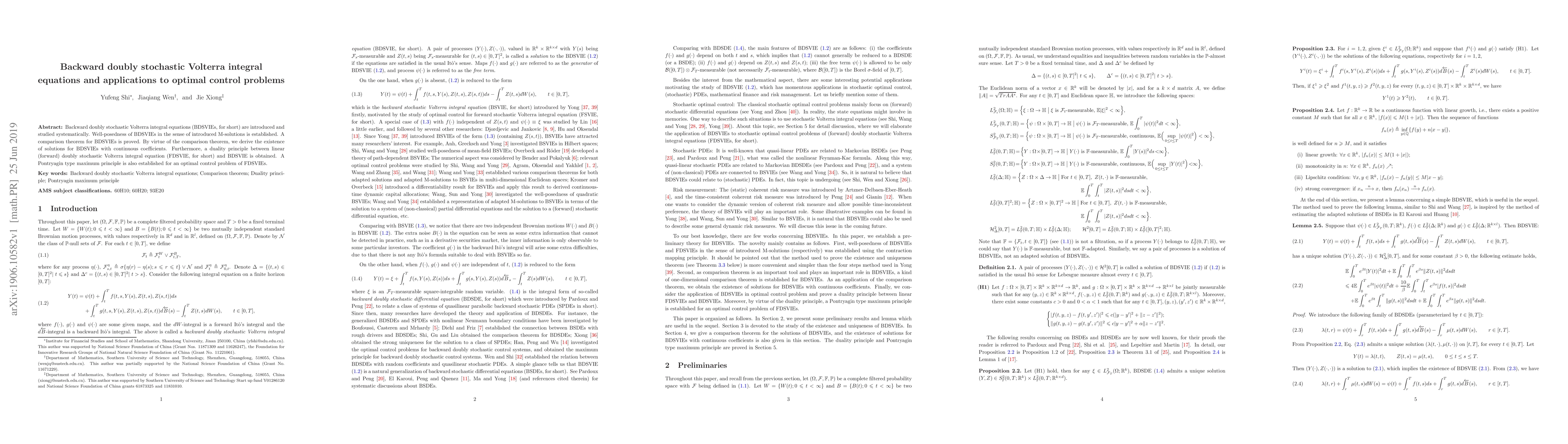

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)