Summary

The simulation of correlated multivariate Poisson processes with negative correlation between their components has many important applications in Finance, Insurance, Geophysics, and many other areas of applied probability. Introduced in our earlier work, the Backward Simulation (BS) approach to the simulation of correlated multivariate Poisson processes is able to capture a wide range of correlation, including extreme positive and extreme negative correlation, that is not possible with other approaches such as the forward simulation approach. Moreover, the BS approach enables simple and efficient generation of sample paths of correlated multivariate Poisson processes. In this work, we extend the BS approach to multivariate mixed Poisson processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

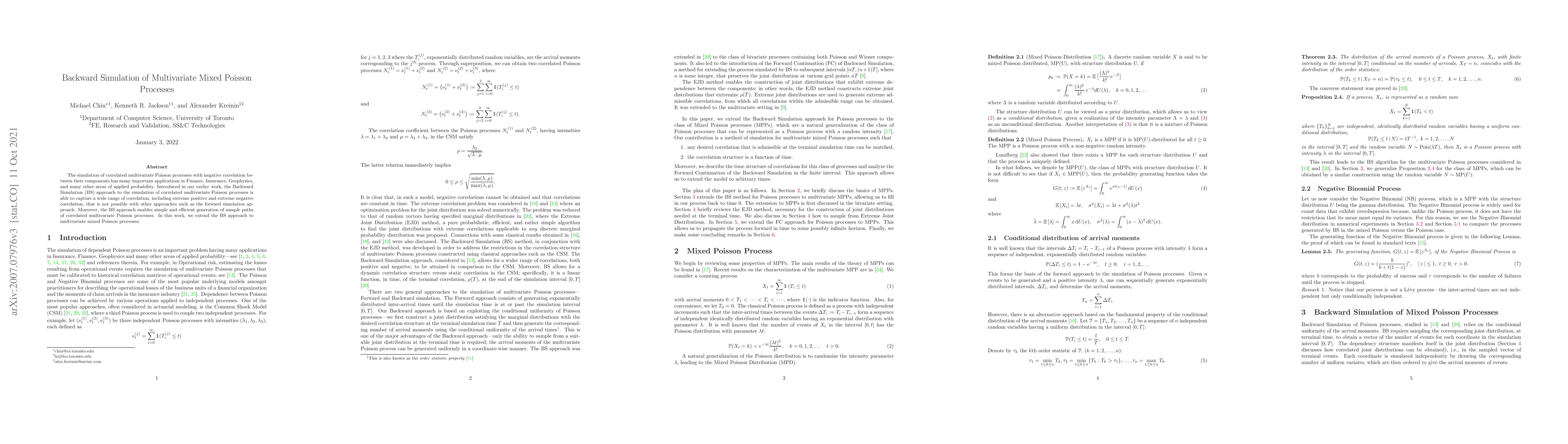

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)