Summary

We discuss an open-loop backward Stackelberg differential game involving single leader and single follower. Unlike most Stackelberg game literature, the state to be controlled is characterized by a backward stochastic differential equation (BSDE) for which the terminal- instead initial-condition is specified as a priori; the decisions of leader consist of a static terminal-perturbation and a dynamic linear-quadratic control. In addition, the terminal control is subject to (convex-closed) pointwise and (affine) expectation constraints. Both constraints are arising from real applications such as mathematical finance. For information pattern: the leader announces both terminal and open-loop dynamic decisions at the initial time while takes account the best response of follower. Then, two interrelated optimization problems are sequentially solved by the follower (a backward linear-quadratic (BLQ) problem) and the leader (a mixed terminal-perturbation and backward-forward LQ (BFLQ) problem). Our open-loop Stackelberg equilibrium is represented by some coupled backward-forward stochastic differential equations (BFSDEs) with mixed initial-terminal conditions. Our BFSDEs also involve nonlinear projection operator (due to pointwise constraint) combining with a Karush-Kuhn-Tucker (KKT) system (due to expectation constraint) via Lagrange multiplier. The global solvability of such BFSDEs is also discussed in some nontrivial cases. Our results are applied to one financial example.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

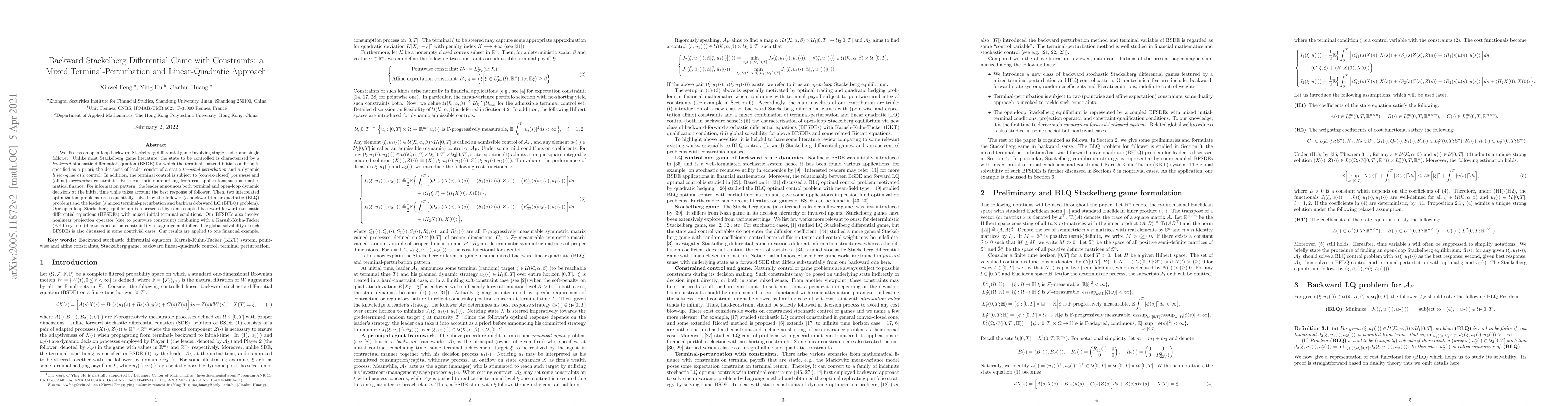

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)