Summary

This paper introduces a backward stochastic differential equation driven by both Brownian motion and a Markov chain (BSDEBM). Regime-switching is also incorporated through its driver. The existence and uniqueness of the solution of the BSDEBM are proved. A comparison theorem is also derived. Filtration consistent sublinear expectations are defined and characterized as solutions to the BSDEBM. The bid and ask prices are then represented using sublinear expectations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

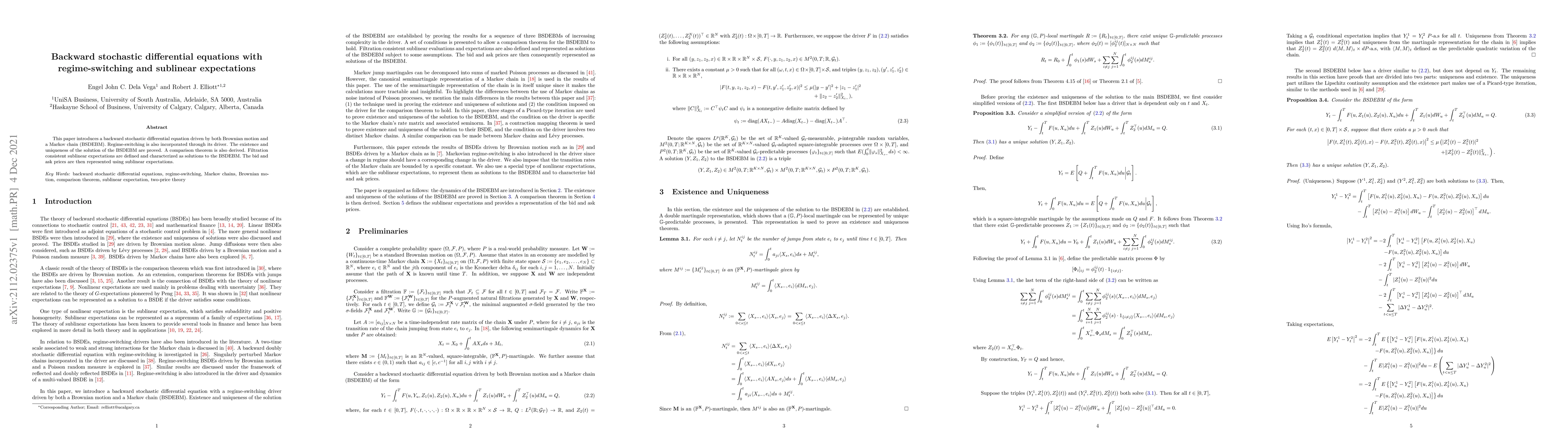

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)