Summary

We study utility maximization problem for general utility functions using dynamic programming approach. We consider an incomplete financial market model, where the dynamics of asset prices are described by an $R^d$-valued continuous semimartingale. Under some regularity assumptions we derive backward stochastic partial differential equation (BSPDE) related directly to the primal problem and show that the strategy is optimal if and only if the corresponding wealth process satisfies a certain forward-SDE. As examples the cases of power, exponential and logarithmic utilities are considered.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

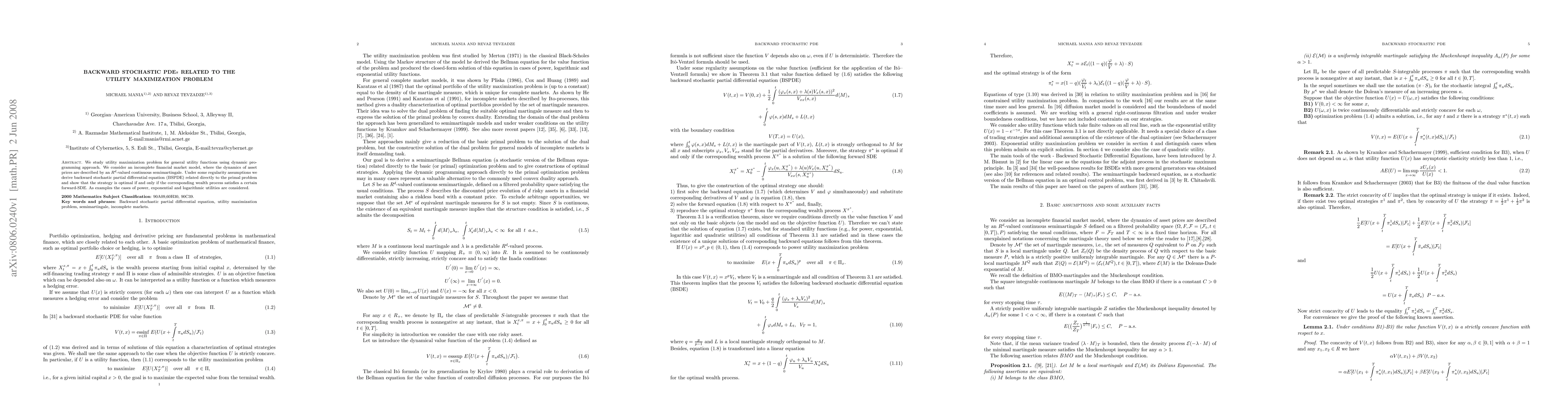

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)