Authors

Summary

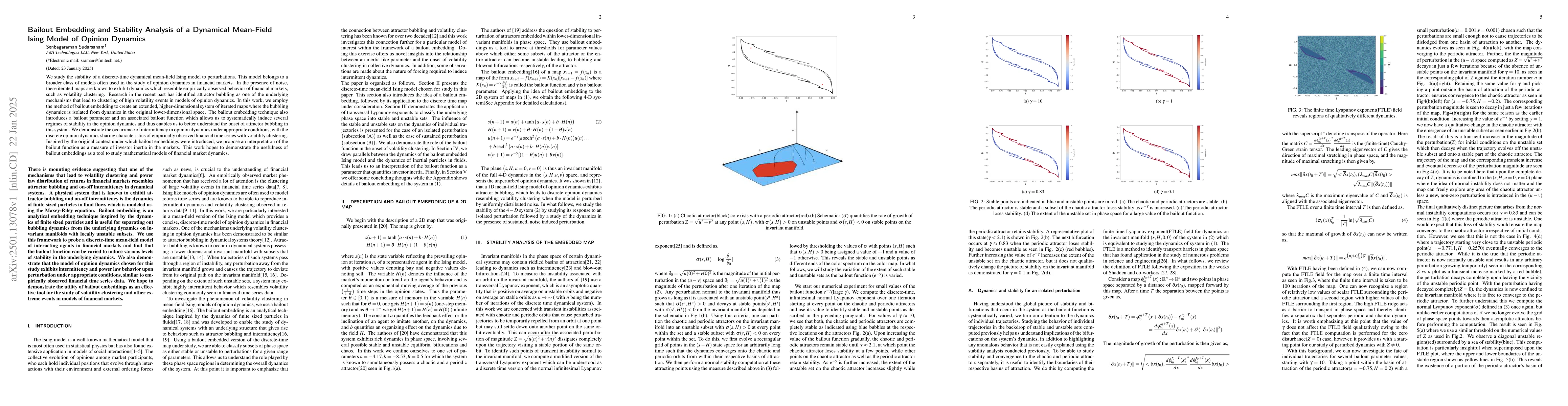

We study the stability of a discrete-time dynamical mean-field Ising model to perturbations. This model belongs to a broader class of models often used in the study of opinion dynamics in financial markets. In the presence of noise, these iterated maps are known to exhibit dynamics which resemble empirically observed behavior of financial markets, such as volatility clustering. Research in the recent past has identified attractor bubbling as one of the underlying mechanisms that lead to clustering of high volatility events in models of opinion dynamics. In this work, we employ the method of bailout embedding to create an extended, higher-dimensional system of iterated maps where the bubbling dynamics is isolated from dynamics in the original lower-dimensional space. The bailout embedding technique also introduces a bailout parameter and an associated bailout function which allows us to systematically induce several regimes of stability in the opinion dynamics and thus enables us to better understand the onset of attractor bubbling in this system. We demonstrate the occurrence of intermittency in opinion dynamics under appropriate conditions, with the discrete opinion dynamics sharing characteristics of empirically observed financial time series with volatility clustering. Inspired by the original context under which bailout embeddings were introduced, we propose an interpretation of the bailout function as a measure of investor inertia in the markets. This work hopes to demonstrate the usefulness of bailout embeddings as a tool to study mathematical models of financial market dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersAnalysis of mean-field approximation for Deffuant opinion dynamics on networks

Kevin Burke, James P. Gleeson, Alina Dubovskaya et al.

Mean-field Concentration of Opinion Dynamics in Random Graphs

Victor Verdugo, David Salas, Javiera Gutiérrez-Ramírez

Virtual walks inspired by a mean field kinetic exchange model of opinion dynamics

Parongama Sen, Surajit Saha

No citations found for this paper.

Comments (0)