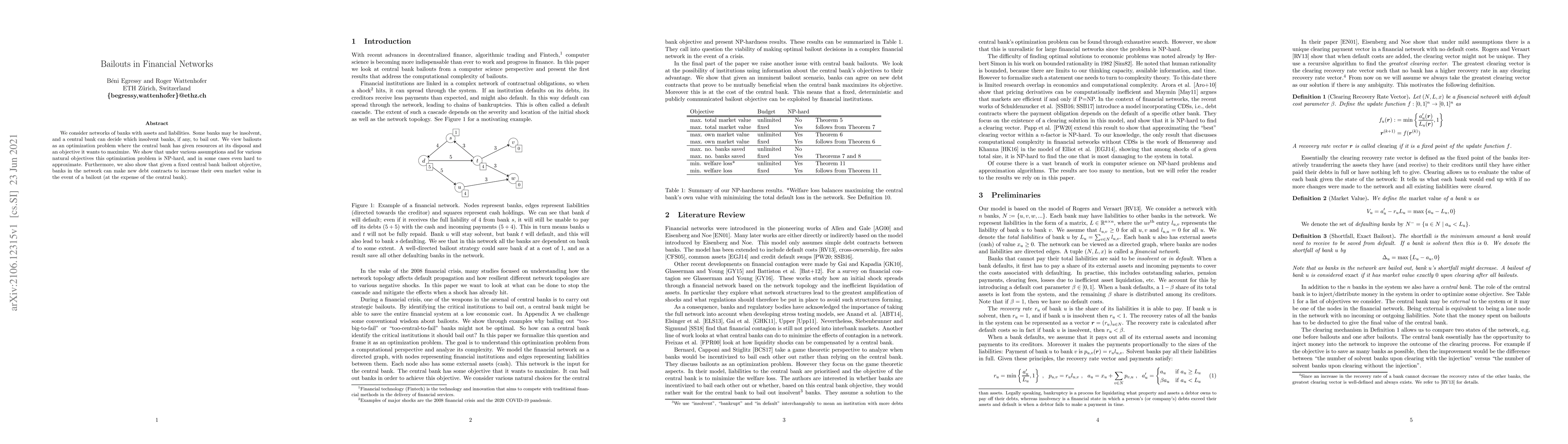

Summary

We consider networks of banks with assets and liabilities. Some banks may be insolvent, and a central bank can decide which insolvent banks, if any, to bail out. We view bailouts as an optimization problem where the central bank has given resources at its disposal and an objective it wants to maximize. We show that under various assumptions and for various natural objectives this optimization problem is NP-hard, and in some cases even hard to approximate. Furthermore, we also show that given a fixed central bank bailout objective, banks in the network can make new debt contracts to increase their own market value in the event of a bailout (at the expense of the central bank).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Bailouts in Diversified Financial Networks

Krishna Dasaratha, Santosh Venkatesh, Rakesh Vohra

Credit Freezes, Equilibrium Multiplicity, and Optimal Bailouts in Financial Networks

Matthew O. Jackson, Agathe Pernoud

| Title | Authors | Year | Actions |

|---|

Comments (0)