Summary

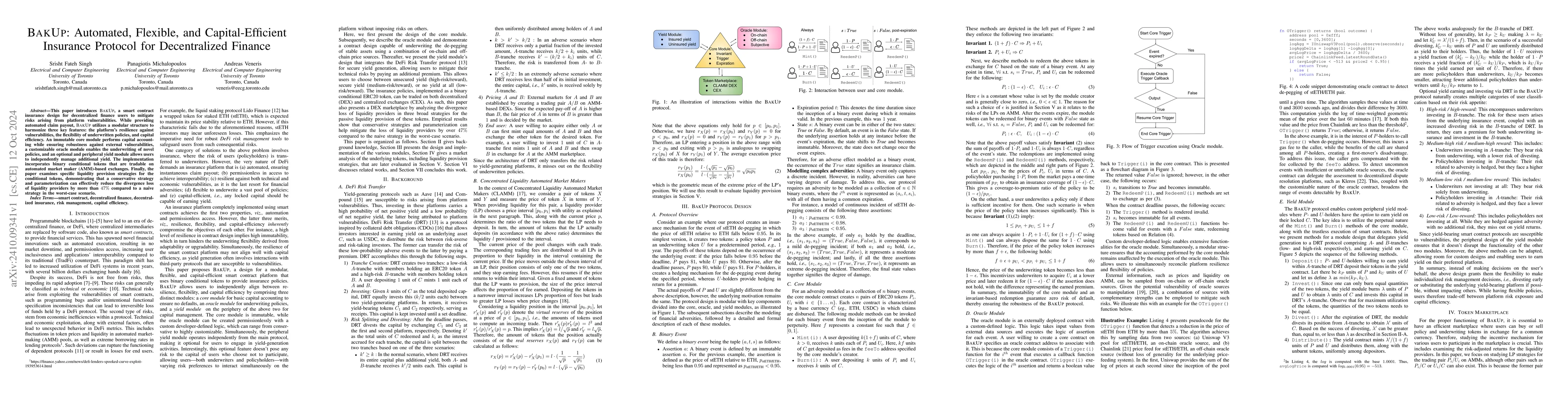

This paper introduces BAKUP, a smart contract insurance design for decentralized finance users to mitigate risks arising from platform vulnerabilities. While providing automated claim payout, BAKUP utilizes a modular structure to harmonize three key features: the platform's resilience against vulnerabilities, the flexibility of underwritten policies, and capital efficiency. An immutable core module performs capital accounting while ensuring robustness against external vulnerabilities, a customizable oracle module enables the underwriting of novel policies, and an optional and peripheral yield module allows users to independently manage additional yield. The implementation incorporates binary conditional tokens that are tradable on automated market maker (AMM)-based exchanges. Finally, the paper examines specific liquidity provision strategies for the conditional tokens, demonstrating that a conservative strategy and parameterization can effectively reduce the divergence loss of liquidity providers by more than 47 % compared to a naive strategy in the worst-case scenario.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeFi Risk Transfer: Towards A Fully Decentralized Insurance Protocol

Fabian Schär, Matthias Nadler, Felix Bekemeier

Insurance-Finance Arbitrage

Thorsten Schmidt, Philippe Artzner, Karl-Theodor Eisele

| Title | Authors | Year | Actions |

|---|

Comments (0)