Summary

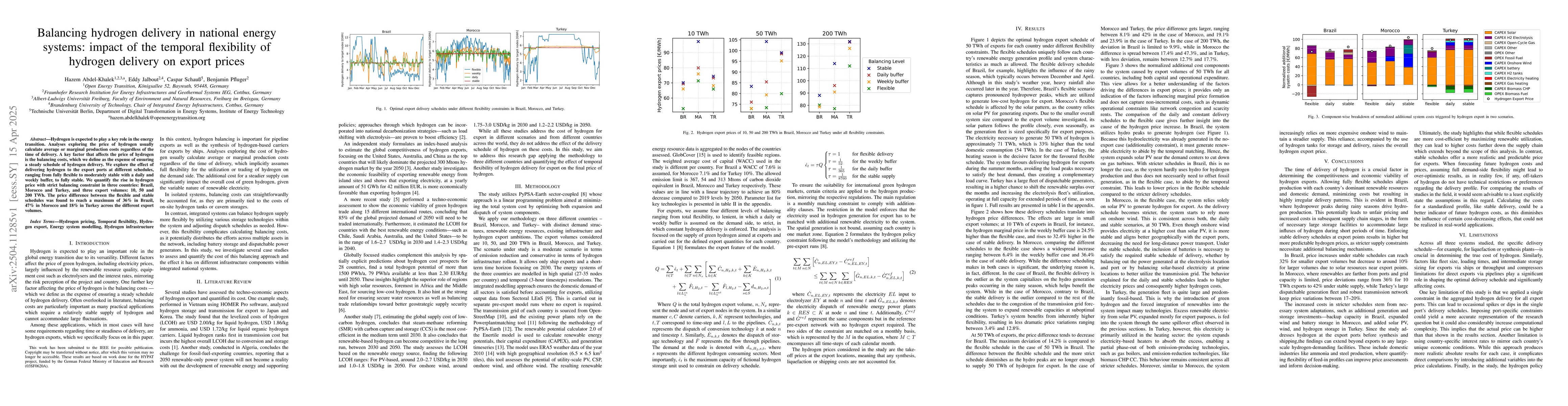

Hydrogen is expected to play a key role in the energy transition. Analyses exploring the price of hydrogen usually calculate average or marginal production costs regardless of the time of delivery. A key factor that affects the price of hydrogen is the balancing costs, which we define as the expense of ensuring a steady schedule of hydrogen delivery. We explore the effect of delivering hydrogen to the export ports at different schedules, ranging from fully flexible to moderately stable with a daily and weekly buffer, to fully stable. We quantify the rise in hydrogen price with strict balancing constraint in three countries: Brazil, Morocco and Turkey, and three export volumes: 10, 50 and 200 TWh. The price difference between the flexible and stable schedules was found to reach a maximum of 36% in Brazil, 47% in Morocco and 18% in Turkey across the different export volumes.

AI Key Findings

Generated Jun 09, 2025

Methodology

The study uses PyPSA-Earth, a linear programming approach, to minimize total system costs by optimizing both expansion and dispatch of system components. It models energy systems of Brazil, Morocco, and Turkey with high spatial and temporal resolution, ensuring domestic demand is satisfied before accounting for exports. The model considers four levels of balancing for hydrogen delivery: total flexibility, lenient (daily or weekly buffer), and strict (constant delivery).

Key Results

- The price difference between flexible and stable delivery schedules can reach up to 36% in Brazil, 47% in Morocco, and 18% in Turkey across different export volumes.

- Brazil's flexible delivery schedule capitalizes on hydroelectricity peaks during the rainy season, while Morocco's flexible schedule relies on solar PV generation.

- Turkey's system benefits from inherent flexibility, resulting in less dramatic price variations compared to Brazil and Morocco.

Significance

This research is important as it highlights the crucial role of hydrogen delivery timing in determining the competitiveness and economic viability of hydrogen exports. It emphasizes the need to consider delivery schedules when forecasting future hydrogen costs and prices.

Technical Contribution

The study presents a methodology for quantifying the effect of temporal flexibility of hydrogen delivery on export prices using PyPSA-Earth, a sector-coupled, open-source, global energy system model.

Novelty

This work distinguishes itself by focusing on the temporal flexibility of hydrogen delivery and its impact on export prices, providing insights into the competitiveness of green hydrogen in international markets.

Limitations

- The study applies a single constraint for aggregated hydrogen delivery across all export ports, which may occasionally cause spikes or dips in individual port delivery schedules.

- Using country-specific interest rates reflects each country's unique economic conditions but complicates direct comparisons by introducing additional variables into price calculations.

Future Work

- Address limitations by adding location-specific constraints, exploring uniform financing assumptions for cross-country comparisons, and adopting stricter or more policy-aligned temporal matching rules.

- Investigate the impact of specific delivery schedules for liquefaction or synthesis plants, fleet sizes, loading times, and intermediate storage sizing for exports via ships or pipelines.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe impact of temporal hydrogen regulation on hydrogen exporters and their domestic energy transition

Falko Ueckerdt, Leon Schumm, Hazem Abdel-Khalek et al.

Powering Europe with North Sea Offshore Wind: The Impact of Hydrogen Investments on Grid Infrastructure and Power Prices

Pedro Crespo del Granado, Goran Durakovic, Asgeir Tomasgard

Research on Flexibility Margin of Electric-Hydrogen Coupling Energy Block Based on Model Predictive Control

Xinyu Mao, Shaohua Ma, Shun Yuan et al.

No citations found for this paper.

Comments (0)