Summary

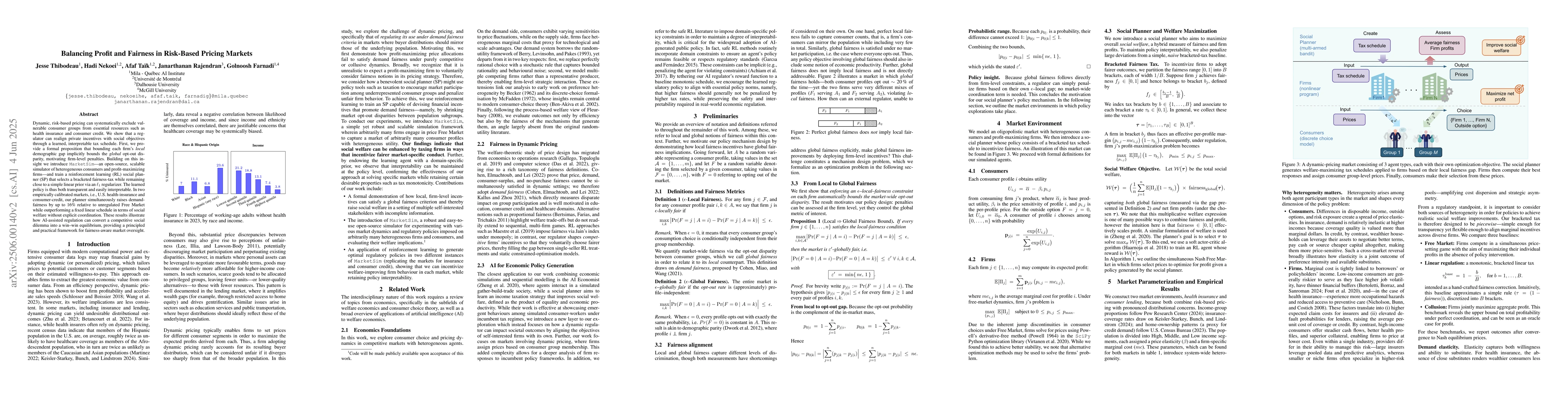

Dynamic, risk-based pricing can systematically exclude vulnerable consumer groups from essential resources such as health insurance and consumer credit. We show that a regulator can realign private incentives with social objectives through a learned, interpretable tax schedule. First, we provide a formal proposition that bounding each firm's \emph{local} demographic gap implicitly bounds the \emph{global} opt-out disparity, motivating firm-level penalties. Building on this insight we introduce \texttt{MarketSim} -- an open-source, scalable simulator of heterogeneous consumers and profit-maximizing firms -- and train a reinforcement learning (RL) social planner (SP) that selects a bracketed fairness-tax while remaining close to a simple linear prior via an $\mathcal{L}_1$ regularizer. The learned policy is thus both transparent and easily interpretable. In two empirically calibrated markets, i.e., U.S. health-insurance and consumer-credit, our planner simultaneously raises demand-fairness by up to $16\%$ relative to unregulated Free Market while outperforming a fixed linear schedule in terms of social welfare without explicit coordination. These results illustrate how AI-assisted regulation can convert a competitive social dilemma into a win-win equilibrium, providing a principled and practical framework for fairness-aware market oversight.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research employs a formal proposition to justify firm-level penalties and introduces MarketSim, a scalable simulator of consumer and firm behaviors. A reinforcement learning social planner is trained using an L1 regularizer to select a bracketed fairness-tax, ensuring transparency and interpretability.

Key Results

- The learned policy raises demand-fairness by up to 16% relative to a free market in U.S. health insurance and consumer credit markets.

- The AI-assisted regulation outperforms a fixed linear schedule in terms of social welfare without explicit coordination.

- The study demonstrates converting a competitive social dilemma into a win-win equilibrium for fairness-aware market oversight.

Significance

This research is important as it provides a practical framework for fairness-aware market oversight using AI-assisted regulation, addressing the exclusion of vulnerable consumer groups from essential resources.

Technical Contribution

The main technical contribution is the development of MarketSim, a scalable simulator, and a reinforcement learning social planner that balances profit and fairness through a learned, interpretable tax schedule.

Novelty

This work stands out by combining reinforcement learning with a formal proposition to justify firm-level penalties, ensuring both transparency and efficiency in regulating risk-based pricing markets.

Limitations

- The study is limited to two empirically calibrated markets: U.S. health insurance and consumer credit.

- Generalizability to other markets or industries may require further investigation.

Future Work

- Explore the applicability of this framework to other markets and industries beyond health insurance and consumer credit.

- Investigate the impact of varying market conditions and consumer demographics on the effectiveness of the proposed regulatory approach.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIndividual Fairness in Feature-Based Pricing for Monopoly Markets

Shweta Jain, Sujit Gujar, Shantanu Das et al.

Online Learning in Betting Markets: Profit versus Prediction

Lexing Xie, Haiqing Zhu, Alexander Soen et al.

Fairness in Credit Scoring: Assessment, Implementation and Profit Implications

Nikita Kozodoi, Stefan Lessmann, Johannes Jacob

No citations found for this paper.

Comments (0)