Summary

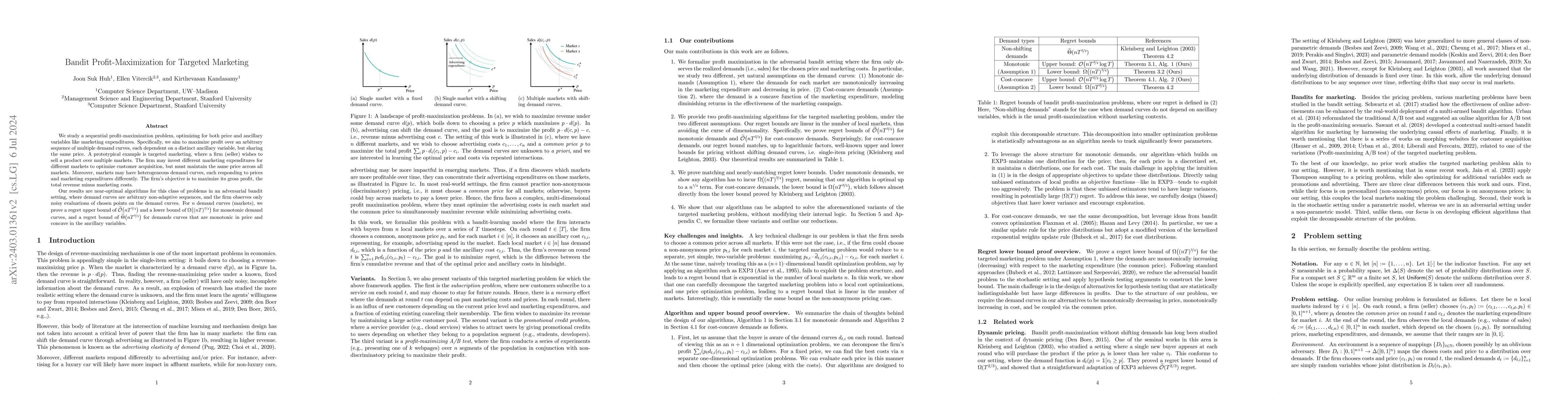

We study a sequential profit-maximization problem, optimizing for both price and ancillary variables like marketing expenditures. Specifically, we aim to maximize profit over an arbitrary sequence of multiple demand curves, each dependent on a distinct ancillary variable, but sharing the same price. A prototypical example is targeted marketing, where a firm (seller) wishes to sell a product over multiple markets. The firm may invest different marketing expenditures for different markets to optimize customer acquisition, but must maintain the same price across all markets. Moreover, markets may have heterogeneous demand curves, each responding to prices and marketing expenditures differently. The firm's objective is to maximize its gross profit, the total revenue minus marketing costs. Our results are near-optimal algorithms for this class of problems in an adversarial bandit setting, where demand curves are arbitrary non-adaptive sequences, and the firm observes only noisy evaluations of chosen points on the demand curves. We prove a regret upper bound of $\widetilde{\mathcal{O}}\big(nT^{3/4}\big)$ and a lower bound of $\Omega\big((nT)^{3/4}\big)$ for monotonic demand curves, and a regret bound of $\widetilde{\Theta}\big(nT^{2/3}\big)$ for demands curves that are monotonic in price and concave in the ancillary variables.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApproximate information maximization for bandit games

Etienne Boursier, Jean-Baptiste Masson, Christian L. Vestergaard et al.

No citations found for this paper.

Comments (0)