Authors

Summary

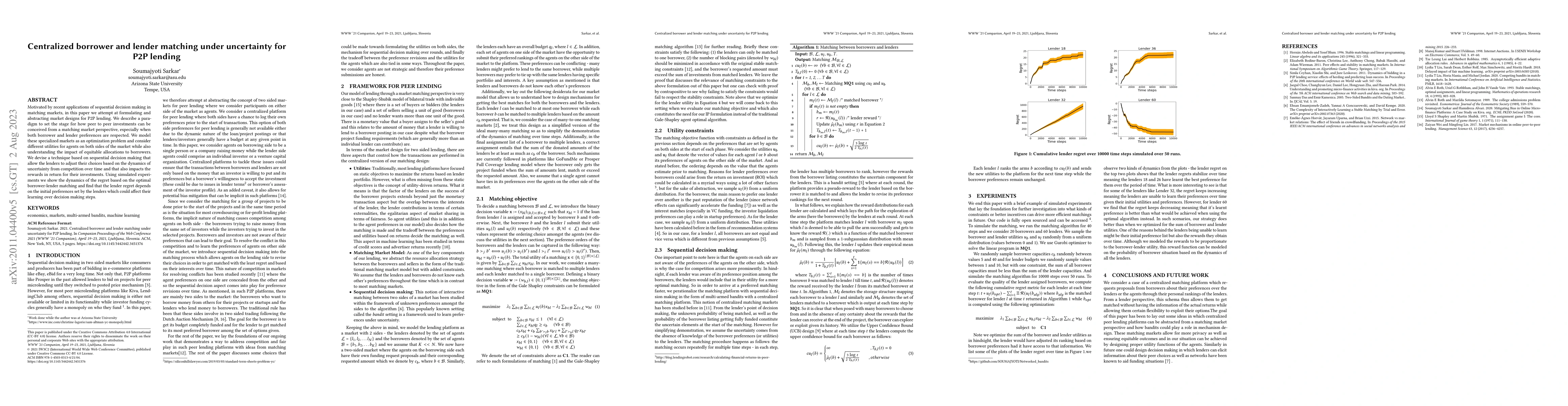

Motivated by recent applications of sequential decision making in matching markets, in this paper we attempt at formulating and abstracting market designs for P2P lending. We describe a paradigm to set the stage for how peer to peer investments can be conceived from a matching market perspective, especially when both borrower and lender preferences are respected. We model these specialized markets as an optimization problem and consider different utilities for agents on both sides of the market while also understanding the impact of equitable allocations to borrowers. We devise a technique based on sequential decision making that allow the lenders to adjust their choices based on the dynamics of uncertainty from competition over time and that also impacts the rewards in return for their investments. Using simulated experiments we show the dynamics of the regret based on the optimal borrower-lender matching and find that the lender regret depends on the initial preferences set by the lenders which could affect their learning over decision making steps.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDecentralized Competing Bandits in Non-Stationary Matching Markets

Kannan Ramchandran, Abishek Sankararaman, Arya Mazumdar et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)