Authors

Summary

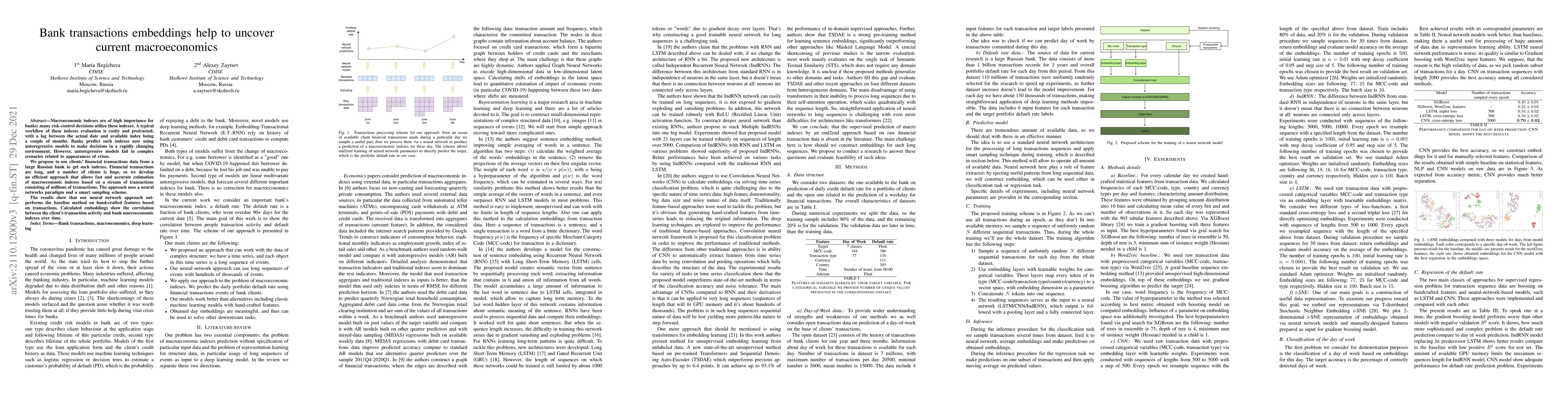

Macroeconomic indexes are of high importance for banks: many risk-control decisions utilize these indexes. A typical workflow of these indexes evaluation is costly and protracted, with a lag between the actual date and available index being a couple of months. Banks predict such indexes now using autoregressive models to make decisions in a rapidly changing environment. However, autoregressive models fail in complex scenarios related to appearances of crises. We propose to use clients' financial transactions data from a large Russian bank to get such indexes. Financial transactions are long, and a number of clients is huge, so we develop an efficient approach that allows fast and accurate estimation of macroeconomic indexes based on a stream of transactions consisting of millions of transactions. The approach uses a neural networks paradigm and a smart sampling scheme. The results show that our neural network approach outperforms the baseline method on hand-crafted features based on transactions. Calculated embeddings show the correlation between the client's transaction activity and bank macroeconomic indexes over time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)