Summary

We present a simple continuous-time model of clearing in financial networks. Financial firms are represented as "tanks" filled with fluid (money), flowing in and out. Once "pipes" connecting "tanks" are open, the system reaches the clearing payment vector in finite time. This approach provides a simple recursive solution to a classical static model of financial clearing in bankruptcy, and suggests a practical payment mechanism. With sufficient resources, a system of mutual obligations can be restructured into an equivalent system that has a cascade structure: there is a group of banks that paid off their debts, another group that owes money only to banks in the first group, and so on. Technically, we use the machinery of Markov chains to analyze evolution of a deterministic dynamical system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

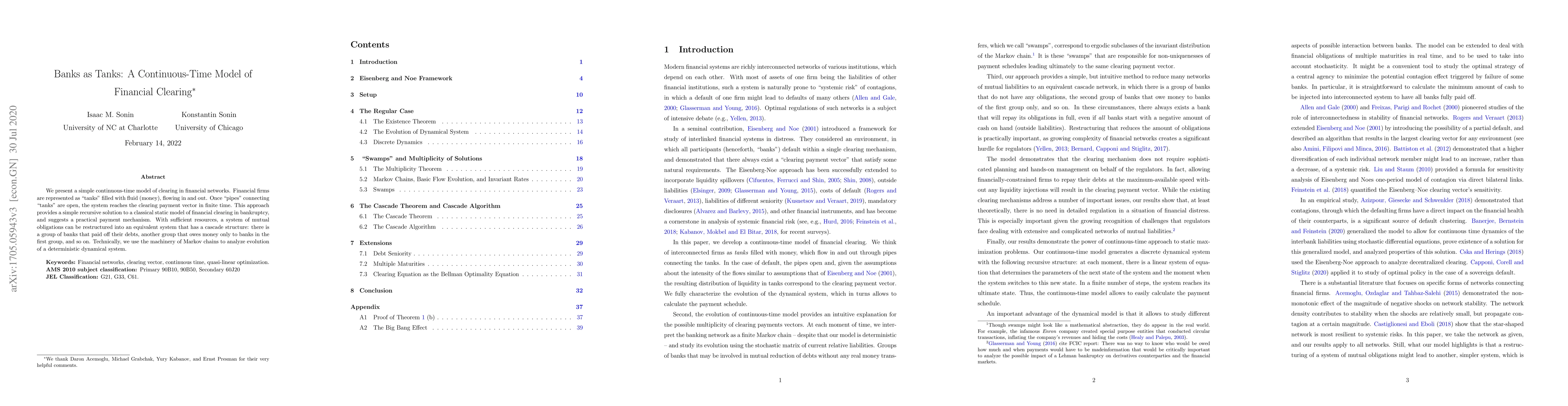

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Clearing Payments in a Financial Contagion Model

Anton V. Proskurnikov, Giuseppe Calafiore, Giulia Fracastoro

Clearing Payments in Dynamic Financial Networks

Anton V. Proskurnikov, Giuseppe C. Calafiore, Giulia Fracastoro

| Title | Authors | Year | Actions |

|---|

Comments (0)