Summary

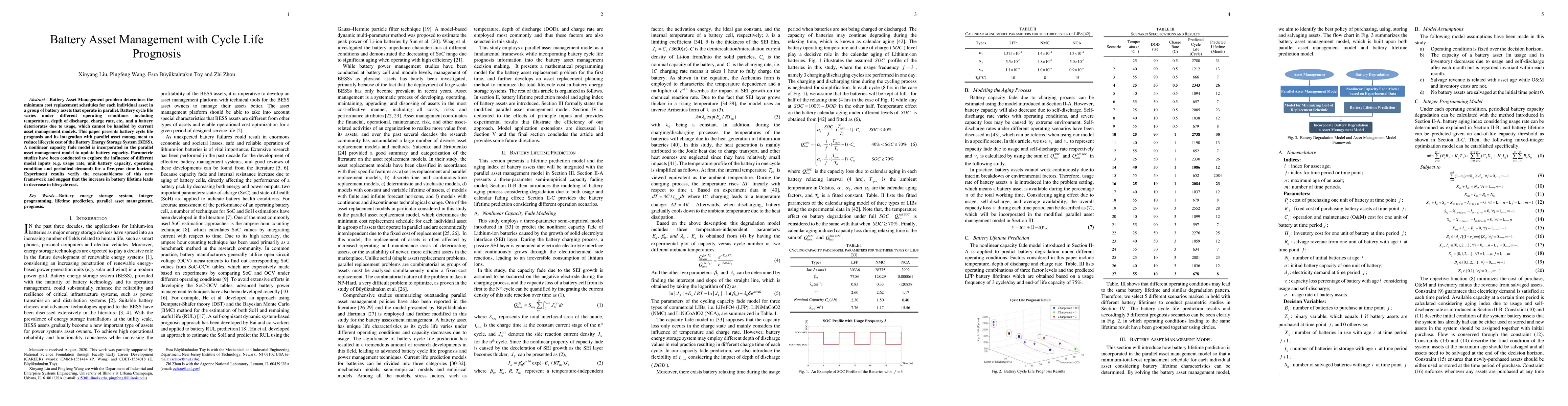

Battery Asset Management problem determines the minimum cost replacement schedules for each individual asset in a group of battery assets that operate in parallel. Battery cycle life varies under different operating conditions including temperature, depth of discharge, charge rate, etc., and a battery deteriorates due to usage, which cannot be handled by current asset management models. This paper presents battery cycle life prognosis and its integration with parallel asset management to reduce lifecycle cost of the Battery Energy Storage System (BESS). A nonlinear capacity fade model is incorporated in the parallel asset management model to update battery capacity. Parametric studies have been conducted to explore the influence of different model inputs (e.g. usage rate, unit battery capacity, operating condition and periodical demand) for a five-year time horizon. Experiment results verify the reasonableness of this new framework and suggest that the increase in battery lifetime leads to decrease in lifecycle cost.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)