Summary

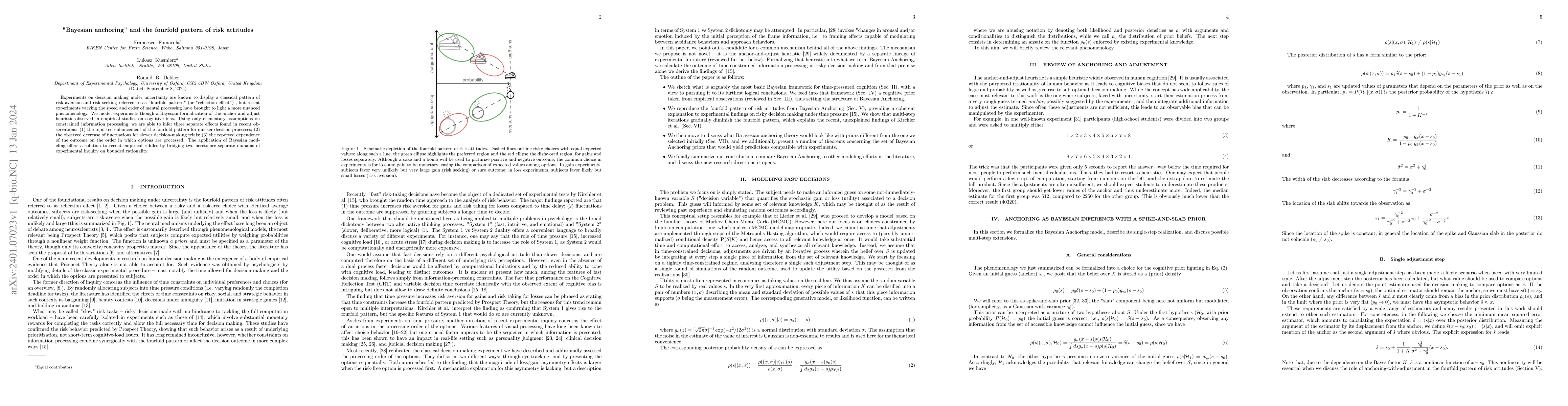

Experiments on decision making under uncertainty are known to display a classical pattern of risk aversion and risk seeking referred to as "fourfold pattern" (or "reflection effect") , but recent experiments varying the speed and order of mental processing have brought to light a more nuanced phenomenology. We model experiments though a Bayesian formalization of the anchor-and-adjust heuristic observed in empirical studies on cognitive bias. Using only elementary assumptions on constrained information processing, we are able to infer three separate effects found in recent observations: (1) the reported enhancement of the fourfold pattern for quicker decision processes; (2) the observed decrease of fluctuations for slower decision-making trials; (3) the reported dependence of the outcome on the order in which options are processed. The application of Bayesian modeling offers a solution to recent empirical riddles by bridging two heretofore separate domains of experimental inquiry on bounded rationality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal allocations with distortion risk measures and mixed risk attitudes

Ruodu Wang, Mario Ghossoub, Qinghua Ren

No citations found for this paper.

Comments (0)