Summary

We consider the valuation problem of an (insurance) company under partial information. Therefore we use the concept of maximizing discounted future dividend payments. The firm value process is described by a diffusion model with constant and observable volatility and constant but unknown drift parameter. For transforming the problem to a problem with complete information, we derive a suitable filter. The optimal value function is characterized as the unique viscosity solution of the associated Hamilton-Jacobi-Bellman equation. We state a numerical procedure for approximating both the optimal dividend strategy and the corresponding value function. Furthermore, threshold strategies are discussed in some detail. Finally, we calculate the probability of ruin in the uncontrolled and controlled situation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

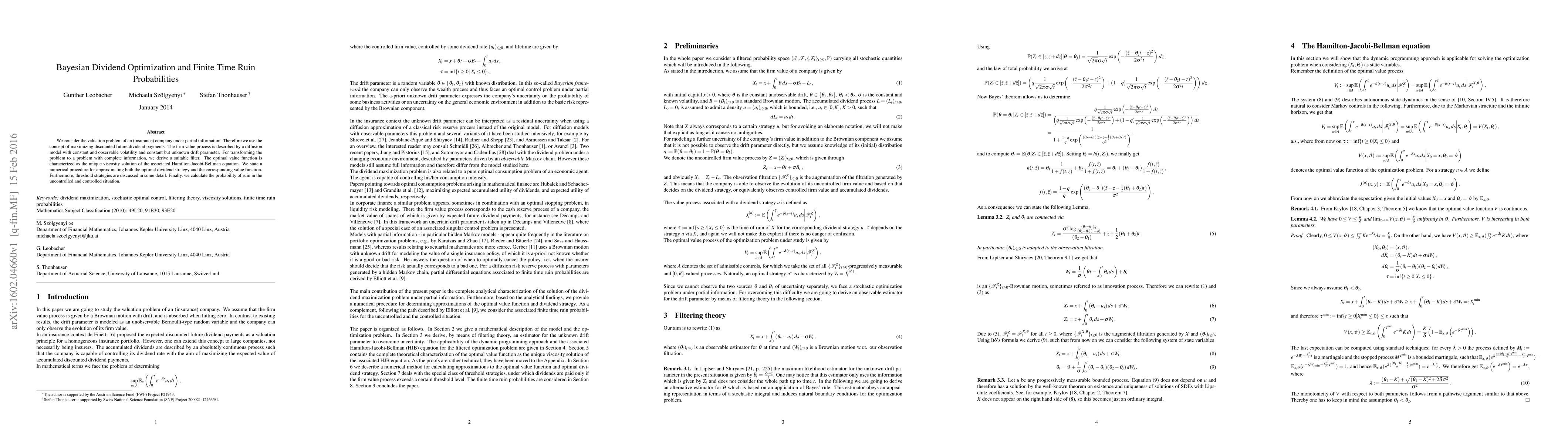

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)