Summary

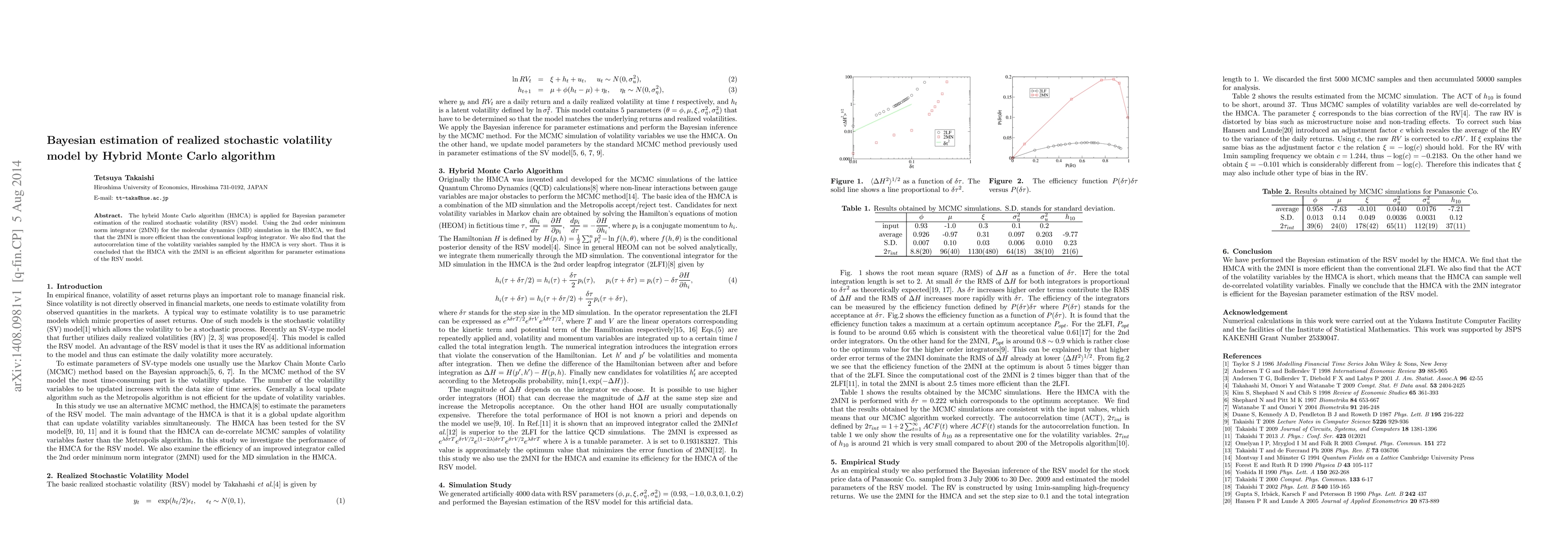

The hybrid Monte Carlo algorithm (HMCA) is applied for Bayesian parameter estimation of the realized stochastic volatility (RSV) model. Using the 2nd order minimum norm integrator (2MNI) for the molecular dynamics (MD) simulation in the HMCA, we find that the 2MNI is more efficient than the conventional leapfrog integrator. We also find that the autocorrelation time of the volatility variables sampled by the HMCA is very short. Thus it is concluded that the HMCA with the 2MNI is an efficient algorithm for parameter estimations of the RSV model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)