Summary

This paper investigates the high-dimensional linear regression with highly correlated covariates. In this setup, the traditional sparsity assumption on the regression coefficients often fails to hold, and consequently many model selection procedures do not work. To address this challenge, we model the variations of covariates by a factor structure. Specifically, strong correlations among covariates are explained by common factors and the remaining variations are interpreted as idiosyncratic components of each covariate. This leads to a factor-adjusted regression model with both common factors and idiosyncratic components as covariates. We generalize the traditional sparsity assumption accordingly and assume that all common factors but only a small number of idiosyncratic components contribute to the response. A Bayesian procedure with a spike-and-slab prior is then proposed for parameter estimation and model selection. Simulation studies show that our Bayesian method outperforms its lasso analogue, manifests insensitivity to the overestimates of the number of common factors, pays a negligible price in the no correlation case, and scales up well with increasing sample size, dimensionality and sparsity. Numerical results on a real dataset of U.S. bond risk premia and macroeconomic indicators lend strong support to our methodology.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

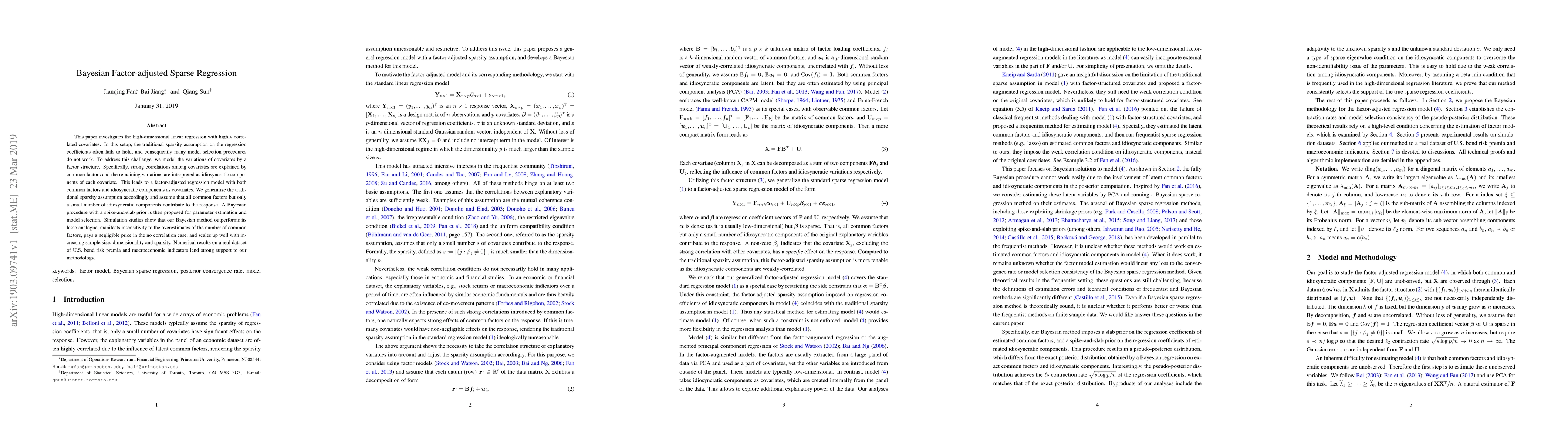

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAre Latent Factor Regression and Sparse Regression Adequate?

Jianqing Fan, Mengxin Yu, Zhipeng Lou

| Title | Authors | Year | Actions |

|---|

Comments (0)