Summary

Recent financial disasters emphasised the need to investigate the consequence associated with the tail co-movements among institutions; episodes of contagion are frequently observed and increase the probability of large losses affecting market participants' risk capital. Commonly used risk management tools fail to account for potential spillover effects among institutions because they provide individual risk assessment. We contribute to analyse the interdependence effects of extreme events providing an estimation tool for evaluating the Conditional Value-at-Risk (CoVaR) defined as the Value-at-Risk of an institution conditioned on another institution being under distress. In particular, our approach relies on Bayesian quantile regression framework. We propose a Markov chain Monte Carlo algorithm exploiting the Asymmetric Laplace distribution and its representation as a location-scale mixture of Normals. Moreover, since risk measures are usually evaluated on time series data and returns typically change over time, we extend the CoVaR model to account for the dynamics of the tail behaviour. Application on U.S. companies belonging to different sectors of the Standard and Poor's Composite Index (S&P500) is considered to evaluate the marginal contribution to the overall systemic risk of each individual institution

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

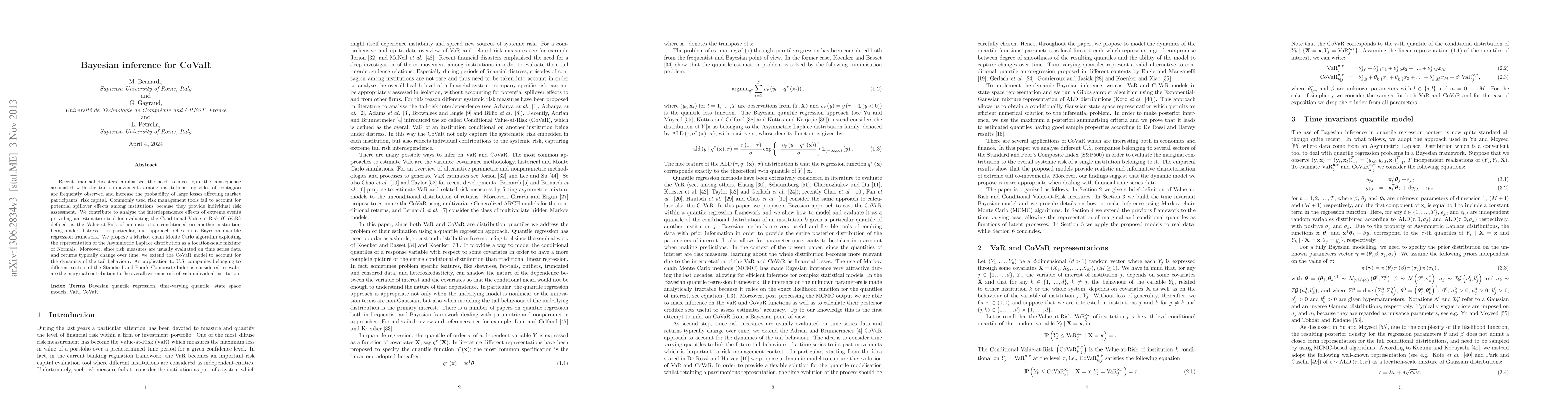

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVulnerability-CoVaR: Investigating the Crypto-market

Ostap Okhrin, Martin Waltz, Abhay Kumar Singh

Preparing Ground and Excited States Using Adiabatic CoVaR

Bálint Koczor, Wooseop Hwang

| Title | Authors | Year | Actions |

|---|

Comments (0)