Summary

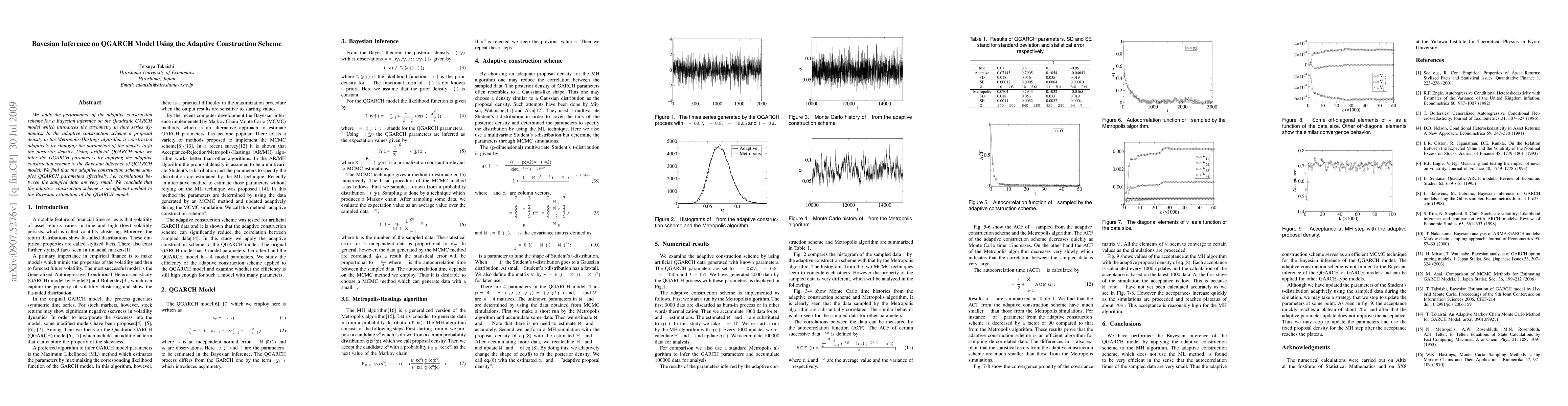

We study the performance of the adaptive construction scheme for a Bayesian inference on the Quadratic GARCH model which introduces the asymmetry in time series dynamics. In the adaptive construction scheme a proposal density in the Metropolis-Hastings algorithm is constructed adaptively by changing the parameters of the density to fit the posterior density. Using artificial QGARCH data we infer the QGARCH parameters by applying the adaptive construction scheme to the Bayesian inference of QGARCH model. We find that the adaptive construction scheme samples QGARCH parameters effectively, i.e. correlations between the sampled data are very small. We conclude that the adaptive construction scheme is an efficient method to the Bayesian estimation of the QGARCH model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)