Authors

Summary

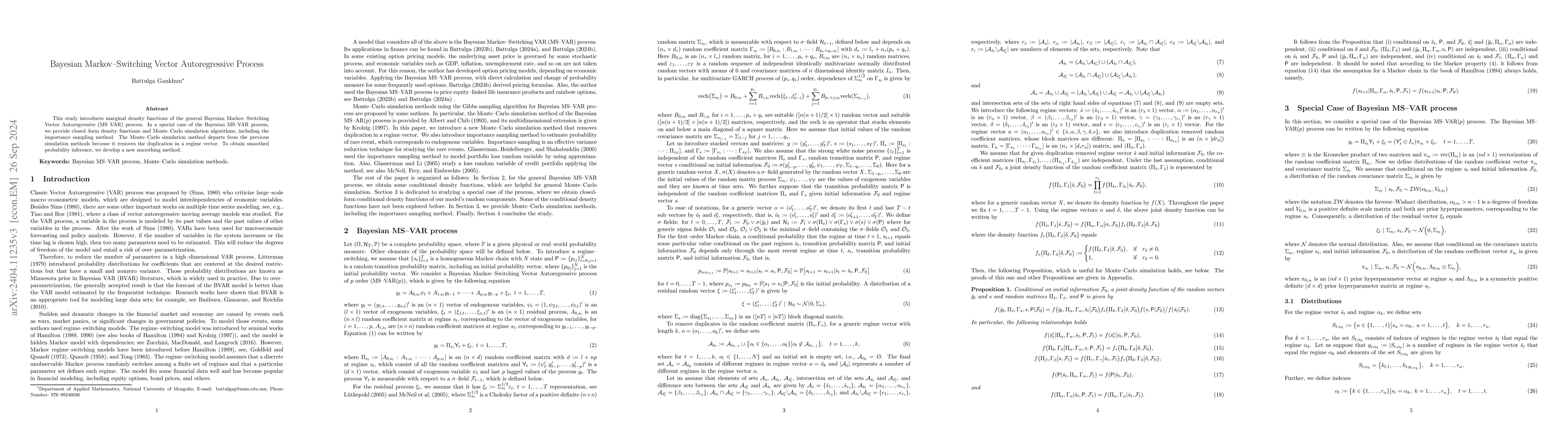

This study introduces marginal density functions of the general Bayesian Markov-Switching Vector Autoregressive (MS-VAR) process. In the case of the Bayesian MS-VAR process, we provide closed--form density functions and Monte-Carlo simulation algorithms, including the importance sampling method. The Monte-Carlo simulation method departs from the previous simulation methods because it removes the duplication in a regime vector.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Inference for Structural Vector Autoregressions Identified by Markov-Switching Heteroskedasticity

Tomasz Woźniak, Helmut Lütkepohl

Bayesian Sparse Vector Autoregressive Switching Models with Application to Human Gesture Phase Segmentation

Marina Vannucci, Beniamino Hadj-Amar, Jack Jewson

| Title | Authors | Year | Actions |

|---|

Comments (0)