Authors

Summary

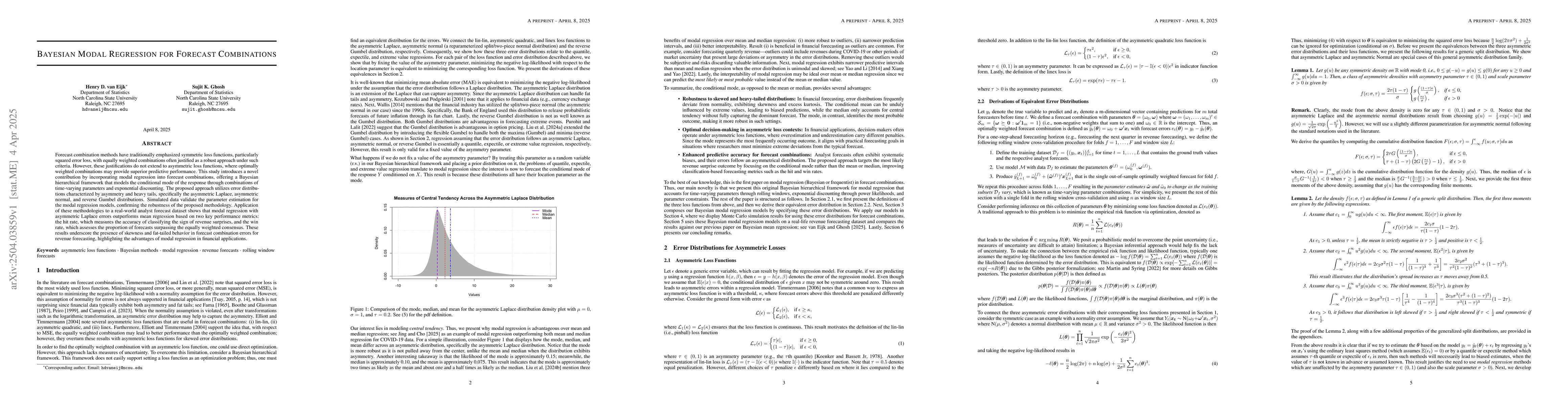

Forecast combination methods have traditionally emphasized symmetric loss functions, particularly squared error loss, with equally weighted combinations often justified as a robust approach under such criteria. However, these justifications do not extend to asymmetric loss functions, where optimally weighted combinations may provide superior predictive performance. This study introduces a novel contribution by incorporating modal regression into forecast combinations, offering a Bayesian hierarchical framework that models the conditional mode of the response through combinations of time-varying parameters and exponential discounting. The proposed approach utilizes error distributions characterized by asymmetry and heavy tails, specifically the asymmetric Laplace, asymmetric normal, and reverse Gumbel distributions. Simulated data validate the parameter estimation for the modal regression models, confirming the robustness of the proposed methodology. Application of these methodologies to a real-world analyst forecast dataset shows that modal regression with asymmetric Laplace errors outperforms mean regression based on two key performance metrics: the hit rate, which measures the accuracy of classifying the sign of revenue surprises, and the win rate, which assesses the proportion of forecasts surpassing the equally weighted consensus. These results underscore the presence of skewness and fat-tailed behavior in forecast combination errors for revenue forecasting, highlighting the advantages of modal regression in financial applications.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces a Bayesian hierarchical framework for forecast combinations, incorporating modal regression with time-varying parameters and exponential discounting, modeling error distributions like asymmetric Laplace, asymmetric normal, and reverse Gumbel.

Key Results

- Modal regression with asymmetric Laplace errors outperforms mean regression in revenue forecasting, as per hit rate and win rate metrics.

- The study validates parameter estimation for modal regression models through simulated data, confirming robustness.

Significance

This research highlights the advantages of modal regression in financial applications, particularly for revenue forecasting, by addressing skewness and fat-tailed behavior in forecast combination errors.

Technical Contribution

The novel Bayesian modal regression framework for forecast combinations, specifically designed for handling asymmetric loss functions and heavy-tailed error distributions.

Novelty

This work differs from existing research by focusing on modal regression within a Bayesian hierarchical structure for forecast combinations, targeting asymmetric loss functions and heavy-tailed error distributions, which are common in financial forecasting contexts.

Limitations

- The paper does not discuss limitations explicitly, but potential limitations could include reliance on specific error distributions and the need for substantial computational resources for Bayesian methods.

Future Work

- Exploration of additional error distributions and their impact on forecast performance.

- Application of the methodology to other forecasting domains beyond revenue forecasting.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Modal Regression based on Mixture Distributions

Qingyang Liu, Xianzheng Huang, Rai Bai

Flexible global forecast combinations

Ryan Thompson, Yilin Qian, Andrey L. Vasnev

Value-Oriented Forecast Combinations for Unit Commitment

Mehrnoush Ghazanfariharandi, Robert Mieth

No citations found for this paper.

Comments (0)