Summary

Bayes Factor (BF) is one of the tools used in Bayesian analysis for model selection. The predictive BF finds application in detecting outliers, which are relevant sources of estimation and forecast errors. An efficient framework for outlier detection is provided and purposely designed for large multidimensional datasets. Online detection and analytical tractability guarantee the procedure's efficiency. The proposed sequential Bayesian monitoring extends the univariate setup to a matrix--variate one. Prior perturbation based on power discounting is applied to obtain tractable predictive BFs. This way, computationally intensive procedures used in Bayesian Analysis are not required. The conditions leading to inconclusive responses in outlier identification are derived, and some robust approaches are proposed that exploit the predictive BF's variability to improve the standard discounting method. The effectiveness of the procedure is studied using simulated data. An illustration is provided through applications to relevant benchmark datasets from macroeconomics and finance.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper proposes a sequential Bayesian monitoring framework for matrix-variate models, utilizing the Bayes Factor (BF) for outlier detection in large multidimensional datasets. It introduces prior perturbation based on power discounting to obtain tractable predictive BFs, avoiding computationally intensive Bayesian Analysis procedures.

Key Results

- An efficient sequential monitoring procedure for matrix-variate datasets is developed, extending the univariate setup.

- Conditions for inconclusive responses in outlier identification are derived, and robust approaches are proposed to improve the standard discounting method.

- The effectiveness of the procedure is demonstrated through simulations and applications to benchmark datasets from macroeconomics and finance.

- The method is validated using major global event dates such as the COVID-19 pandemic, the Ukrainian conflict, and the rise in inflation.

- The proposed approach outperforms classical frequentist tests for outliers, such as Grubbs' and Generalized Extreme Studentized Deviate (GESD) tests.

Significance

This research is significant as it provides a computationally efficient method for outlier detection in large, multidimensional datasets, which is crucial for accurate estimation and forecasting in various fields, including economics and finance.

Technical Contribution

The paper introduces a novel sequential Bayesian monitoring framework for matrix-variate models, incorporating power discounting to ensure analytical tractability and computational efficiency.

Novelty

The proposed method extends the univariate Bayesian outlier detection to matrix-variate models, offering a computationally efficient alternative to traditional Bayesian analysis techniques, particularly beneficial for large datasets.

Limitations

- The method assumes normality, which may not always hold in real-world data.

- The performance of the proposed method heavily relies on the choice of the discounting coefficient αt.

Future Work

- Investigate the method's performance on datasets with different characteristics and dimensions.

- Explore alternative methods for choosing the discounting coefficient αt to reduce dependency on user-specified parameters.

Paper Details

PDF Preview

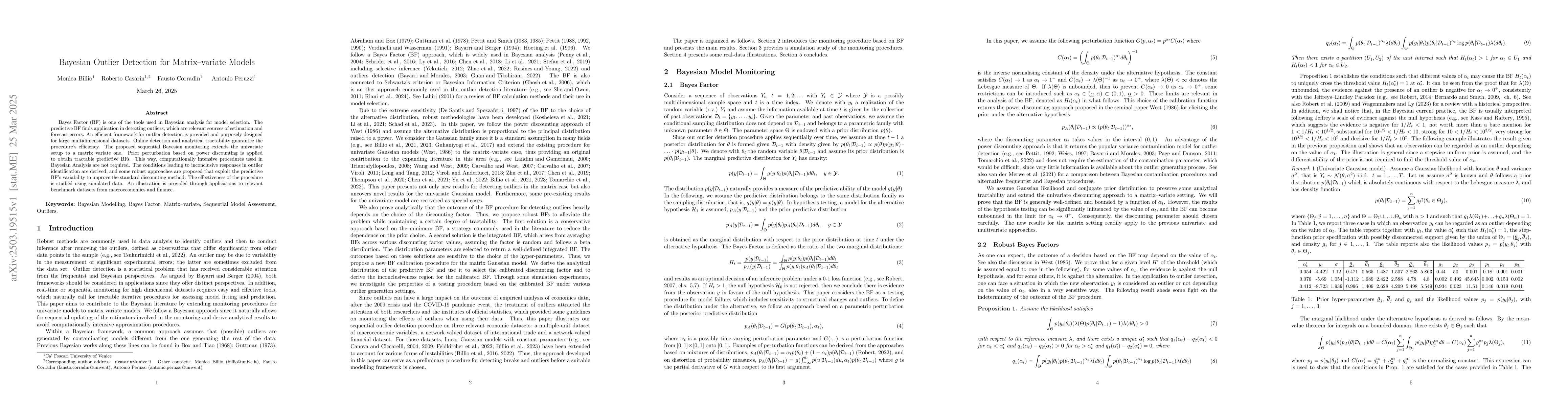

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust covariance estimation and explainable outlier detection for matrix-valued data

Peter Filzmoser, Marcus Mayrhofer, Una Radojičić

No citations found for this paper.

Comments (0)