Summary

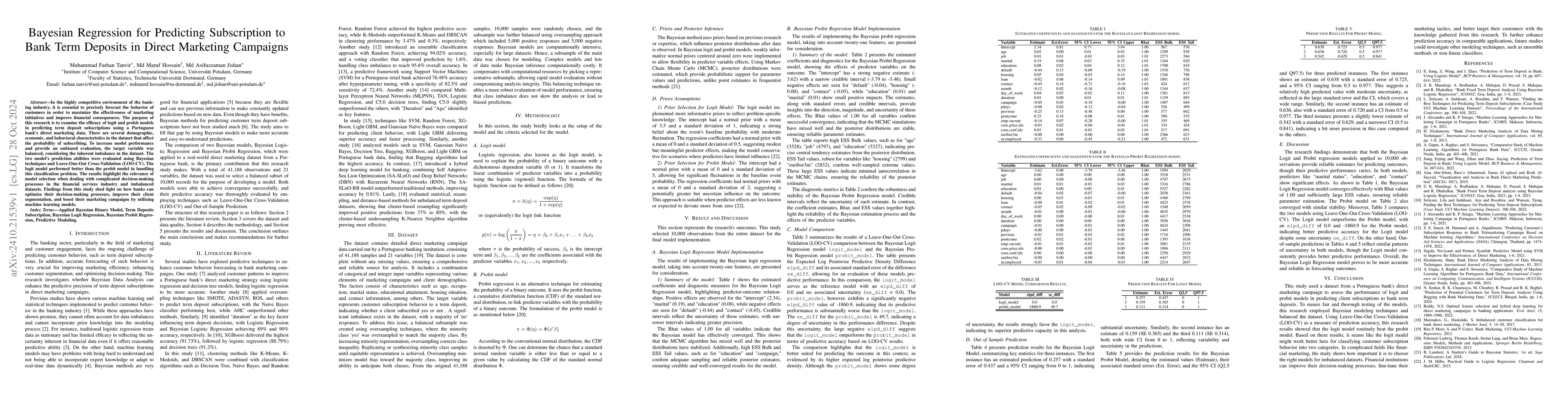

In the highly competitive environment of the banking industry, it is essential to precisely forecast the behavior of customers in order to maximize the effectiveness of marketing initiatives and improve financial consequences. The purpose of this research is to examine the efficacy of logit and probit models in predicting term deposit subscriptions using a Portuguese bank's direct marketing data. There are several demographic, economic, and behavioral characteristics in the dataset that affect the probability of subscribing. To increase model performance and provide an unbiased evaluation, the target variable was balanced, considering the inherent imbalance in the dataset. The two model's prediction abilities were evaluated using Bayesian techniques and Leave-One-Out Cross-Validation (LOO-CV). The logit model performed better than the probit model in handling this classification problem. The results highlight the relevance of model selection when dealing with complicated decision-making processes in the financial services industry and imbalanced datasets. Findings from this study shed light on how banks can optimize their decision-making processes, improve their client segmentation, and boost their marketing campaigns by utilizing machine learning models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHierarchical Capsule Prediction Network for Marketing Campaigns Effect

Zhixuan Chu, Hui Ding, Guang Zeng et al.

No citations found for this paper.

Comments (0)