Summary

In many natural settings agents participate in multiple different auctions that are not simultaneous. In such auctions, future opportunities affect strategic considerations of the players. The goal of this paper is to develop a quantitative understanding of outcomes of such sequential auctions. In earlier work (Paes Leme et al. 2012) we initiated the study of the price of anarchy in sequential auctions. We considered sequential first price auctions in the full information model, where players are aware of all future opportunities, as well as the valuation of all players. In this paper, we study efficiency in sequential auctions in the Bayesian environment, relaxing the informational assumption on the players. We focus on two environments, both studied in the full information model in Paes Leme et al. 2012, matching markets and matroid auctions. In the full information environment, a sequential first price cut auction for matroid settings is efficient. In Bayesian environments this is no longer the case, as we show using a simple example with three players. Our main result is a bound of $1+\frac{e}{e-1}\approx 2.58$ on the price of anarchy in both matroid auctions and single-value matching markets (even with correlated types) and a bound of $2\frac{e}{e-1}\approx 3.16$ for general matching markets with independent types. To bound the price of anarchy we need to consider possible deviations at an equilibrium. In a sequential Bayesian environment the effect of deviations is more complex than in one-shot games; early bids allow others to infer information about the player's value. We create effective deviations despite the presence of this difficulty by introducing a bluffing technique of independent interest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

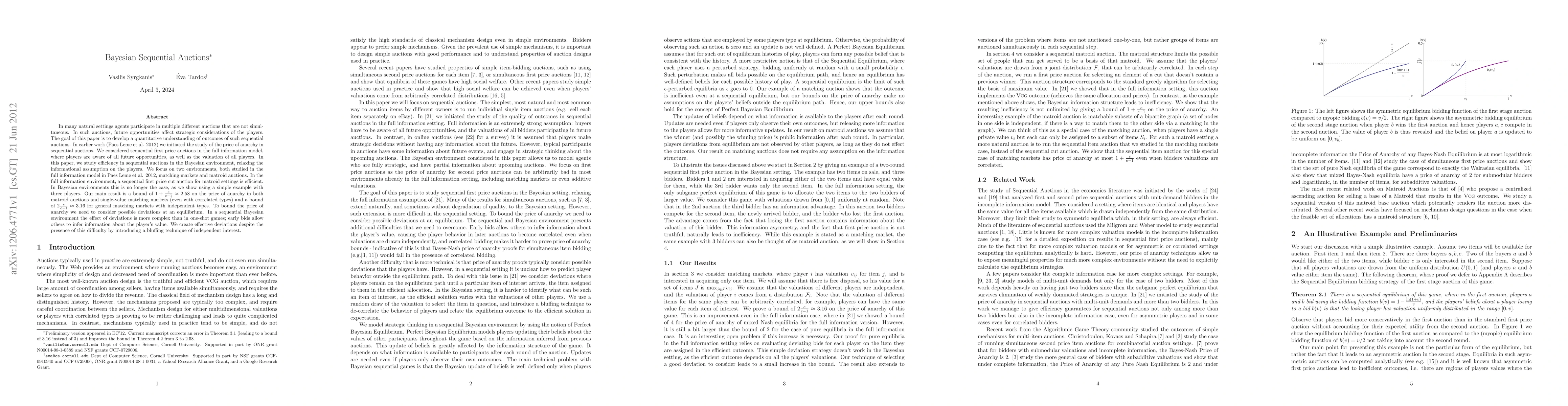

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComputing Perfect Bayesian Equilibria in Sequential Auctions

Vinzenz Thoma, Sven Seuken, Vitor Bosshard

| Title | Authors | Year | Actions |

|---|

Comments (0)