Summary

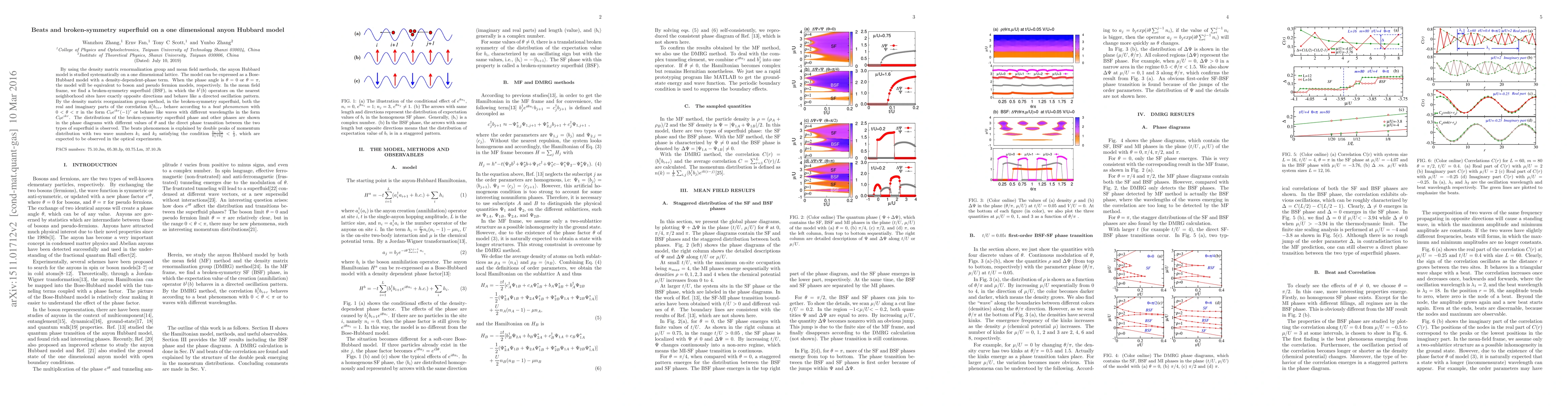

By using the density matrix renormalization group and mean field methods, the anyon Hubbard model is studied systematically on a one dimensional lattice. The model can be expressed as a Bose-Hubbard model with a density-dependent-phase term. When the phase angle is $\theta=0$ or $\theta=\pi$, the model will be equivalent to boson and pseudo fermion models, respectively. In the mean field frame, we find a broken-symmetry superfluid (BSF), in which the $b^{\dagger}(b)$ operators on the nearest neighborhood sites have exactly opposite directions and behave like a directed oscillation pattern. By the density matrix reorganization group method, in the broken-symmetry superfluid, both the real and imaginary parts of the correlation $b^{\dagger}_ib_{i+r}$ behave according to a {\it beat phenomenon} with $0<\theta<\pi$ in the form $C_0e^{i k r}(-1)^{r}$ or behave like waves with different wavelengths in the form $C_0e^{i k r}$. The distributions of the broken-symmetry superfluid phase and other phases are shown in the phase diagrams with different values of $\theta$ and the direct phase transition between the two types of superfluid is observed. The beats phenomenon is explained by double peaks of momentum distribution with two wave numbers ${k}_1$ and ${k}_2$ satisfying the condition $\frac{{k}_1-{k}_2}{{k}_1+{k}_2}<\frac{1}{3}$, which are expected to be observed in the optical experiments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)