Authors

Summary

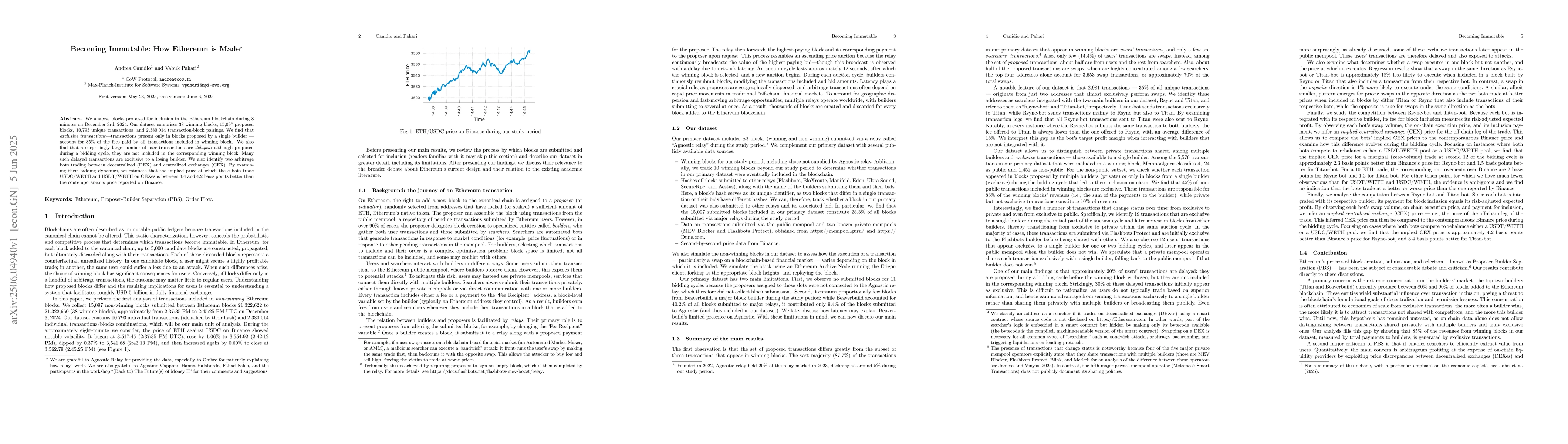

We analyze blocks proposed for inclusion in the Ethereum blockchain during 8 minutes on December 3rd, 2024. Our dataset comprises 38 winning blocks, 15,097 proposed blocks, 10,793 unique transactions, and 2,380,014 transaction-block pairings. We find that exclusive transactions--transactions present only in blocks proposed by a single builder--account for 85% of the fees paid by all transactions included in winning blocks. We also find that a surprisingly large number of user transactions are delayed: although proposed during a bidding cycle, they are not included in the corresponding winning block. Many such delayed transactions are exclusive to a losing builder. We also identify two arbitrage bots trading between decentralized (DEX) and centralized exchanges (CEX). By examining their bidding dynamics, we estimate that the implied price at which these bots trade USDC/WETH and USDT/WETH on CEXes is between 3.4 and 4.2 basis points better than the contemporaneous price reported on Binance.

AI Key Findings

Generated Jun 08, 2025

Methodology

The study analyzes Ethereum blockchain blocks proposed over an 8-minute period on December 3rd, 2024, examining 38 winning blocks, 15,097 proposed blocks, 10,793 unique transactions, and 2,380,014 transaction-block pairings.

Key Results

- Exclusive transactions (present only in blocks proposed by a single builder) account for 85% of the fees paid by all transactions included in winning blocks.

- A significant number of user transactions are delayed, not included in the corresponding winning block, with many being exclusive to losing builders.

- Two arbitrage bots trading between DEX and CEX are identified, suggesting their implied trade prices on CEXes are 3.4 to 4.2 basis points better than Binance's reported price.

Significance

This research provides insights into Ethereum's block proposal and inclusion processes, highlighting the economic dynamics of transaction fees and delays, as well as the pricing discrepancies in cryptocurrency trading across decentralized and centralized exchanges.

Technical Contribution

The paper presents a detailed analysis of Ethereum block proposal and inclusion dynamics, revealing patterns in transaction fees, delays, and arbitrage opportunities across DEX and CEX.

Novelty

This work distinguishes itself by examining the economic aspects of Ethereum block production, identifying the prevalence of exclusive transactions and delayed user transactions, and uncovering arbitrage bot trading dynamics that expose pricing discrepancies between DEX and CEX.

Limitations

- The study is limited to a single 8-minute period on December 3rd, 2024, which may not be representative of Ethereum's behavior over longer timeframes or different conditions.

- Findings might not generalize to other blockchain networks with varying designs or economic incentives.

Future Work

- Investigate Ethereum's behavior over extended periods and under varying network conditions.

- Explore the implications of these findings on other blockchain networks and their respective economic models.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNot so immutable: Upgradeability of Smart Contracts on Ethereum

Jeremy Clark, Mohammad Mannan, Mehdi Salehi

Specification is Law: Safe Creation and Upgrade of Ethereum Smart Contracts

Pedro Antonino, Augusto Sampaio, Juliandson Ferreira et al.

No citations found for this paper.

Comments (0)