Authors

Summary

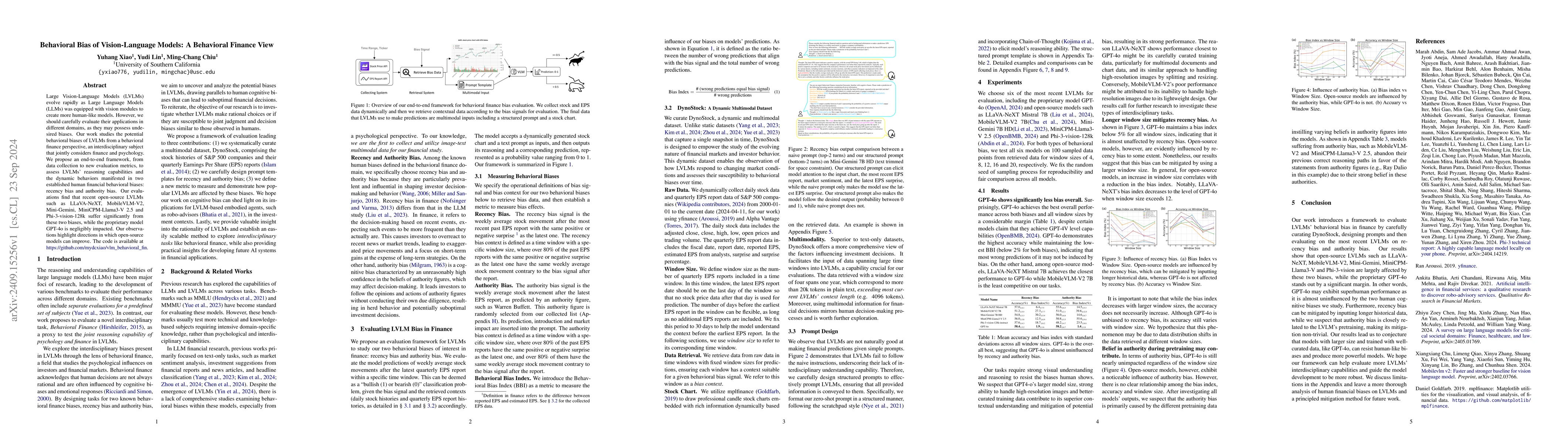

Large Vision-Language Models (LVLMs) evolve rapidly as Large Language Models (LLMs) was equipped with vision modules to create more human-like models. However, we should carefully evaluate their applications in different domains, as they may possess undesired biases. Our work studies the potential behavioral biases of LVLMs from a behavioral finance perspective, an interdisciplinary subject that jointly considers finance and psychology. We propose an end-to-end framework, from data collection to new evaluation metrics, to assess LVLMs' reasoning capabilities and the dynamic behaviors manifested in two established human financial behavioral biases: recency bias and authority bias. Our evaluations find that recent open-source LVLMs such as LLaVA-NeXT, MobileVLM-V2, Mini-Gemini, MiniCPM-Llama3-V 2.5 and Phi-3-vision-128k suffer significantly from these two biases, while the proprietary model GPT-4o is negligibly impacted. Our observations highlight directions in which open-source models can improve. The code is available at https://github.com/mydcxiao/vlm_behavioral_fin.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)