Summary

This paper formulates and studies a general continuous-time behavioral portfolio selection model under Kahneman and Tversky's (cumulative) prospect theory, featuring S-shaped utility (value) functions and probability distortions. Unlike the conventional expected utility maximization model, such a behavioral model could be easily mis-formulated (a.k.a. ill-posed) if its different components do not coordinate well with each other. Certain classes of an ill-posed model are identified. A systematic approach, which is fundamentally different from the ones employed for the utility model, is developed to solve a well-posed model, assuming a complete market and general It\^o processes for asset prices. The optimal terminal wealth positions, derived in fairly explicit forms, possess surprisingly simple structure reminiscent of a gambling policy betting on a good state of the world while accepting a fixed, known loss in case of a bad one. An example with a two-piece CRRA utility is presented to illustrate the general results obtained, and is solved completely for all admissible parameters. The effect of the behavioral criterion on the risky allocations is finally discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

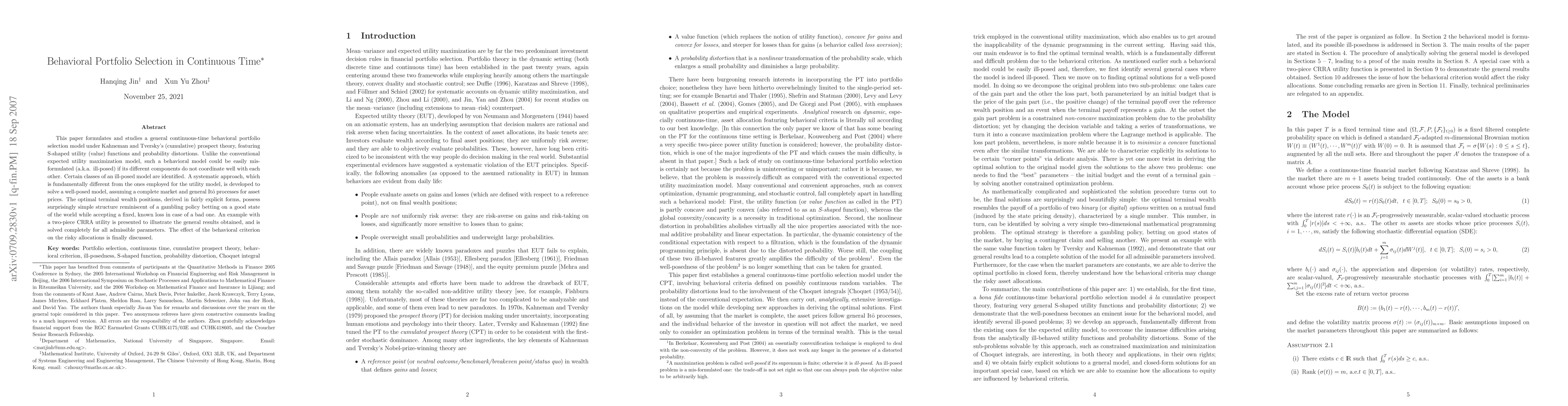

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)