Authors

Summary

The impact of non-deterministic outputs from Large Language Models (LLMs) is not well examined for financial text understanding tasks. Through a compelling case study on investing in the US equity market via news sentiment analysis, we uncover substantial variability in sentence-level sentiment classification results, underscoring the innate volatility of LLM outputs. These uncertainties cascade downstream, leading to more significant variations in portfolio construction and return. While tweaking the temperature parameter in the language model decoder presents a potential remedy, it comes at the expense of stifled creativity. Similarly, while ensembling multiple outputs mitigates the effect of volatile outputs, it demands a notable computational investment. This work furnishes practitioners with invaluable insights for adeptly navigating uncertainty in the integration of LLMs into financial decision-making, particularly in scenarios dictated by non-deterministic information.

AI Key Findings

Generated Sep 02, 2025

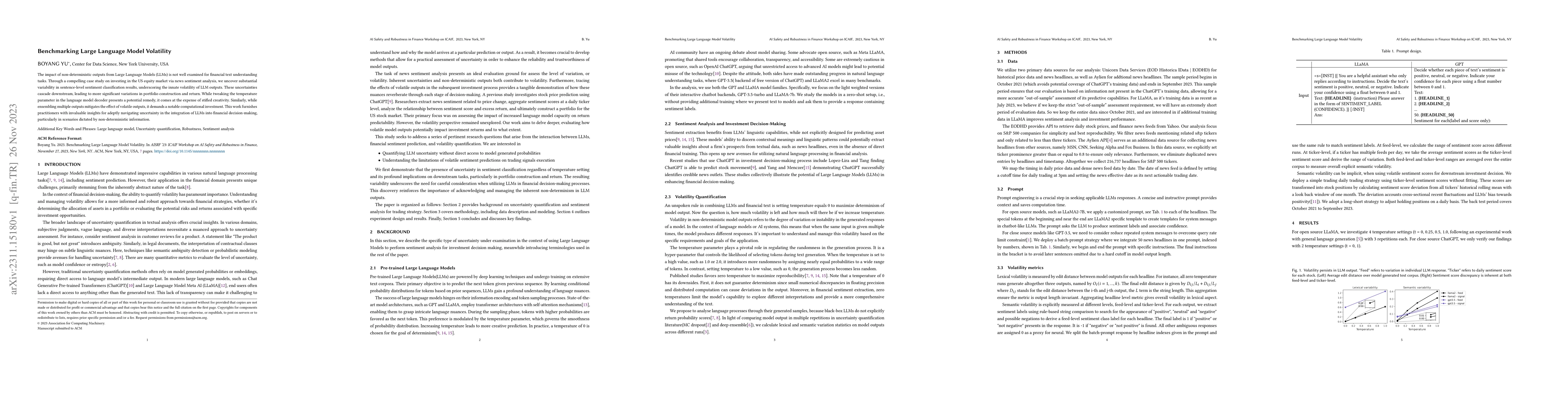

Methodology

The study utilizes two primary data sources: Unicorn Data Services for historical price data and news headlines, and Aylien for additional news headlines. The analysis focuses on S&P500 companies, filtering news feeds mentioning related tickers. Prompt engineering is crucial, with customized prompts for open-source models like LLaMA2-7B and a batch-prompt strategy for closed-source models like GPT-3.5. Volatility metrics include lexical volatility (edit distance) and semantic volatility (sentiment discrepancy) at feed and ticker levels.

Key Results

- Non-deterministic LLM outputs show persistent lexical and semantic volatility, with average edit distances greater than zero for all temperature settings.

- Lower temperatures reduce volatility but underperform compared to higher temperatures, highlighting concerns about AI robustness in safety-critical systems.

- A long-short trading strategy demonstrates volatile returns using LLM sentiment scores, with higher temperatures producing more volatile investment strategies.

Significance

This research provides insights into managing uncertainty in integrating LLMs into financial decision-making, particularly in scenarios involving non-deterministic information, and helps practitioners navigate the inherent volatility of LLM outputs.

Technical Contribution

The paper proposes a methodology for quantifying LLM uncertainty without direct access to model-generated probabilities, focusing on lexical and semantic variations in modeled outputs.

Novelty

This work delves deeper into evaluating the volatility perspective of LLM outputs on investment returns, addressing an unexplored aspect in previous studies on LLMs and financial sentiment prediction.

Limitations

- The study focuses on a limited set of models (GPT-3.5-turbo and LLaMA-7b) and temperature settings, which may not generalize to all LLMs.

- The analysis is based on historical data and may not capture future changes in LLM performance or financial market dynamics.

Future Work

- Investigate the impact of additional training data on LLaMA's sentiment analysis and investment performance.

- Explore low-volatile and token-efficient prompts to minimize variability in LLM-generated responses.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBenchmarking Large Language Model Capabilities for Conditional Generation

Sebastian Gehrmann, Priyanka Agrawal, Joshua Maynez

BELL: Benchmarking the Explainability of Large Language Models

Syed Quiser Ahmed, Bharathi Vokkaliga Ganesh, Jagadish Babu P et al.

Benchmarking Large Language Model Uncertainty for Prompt Optimization

Yun-Da Tsai, Shou-De Lin, Pei-Fu Guo

| Title | Authors | Year | Actions |

|---|

Comments (0)